“Touch ‘n Go, boleh?” I asked the cashier. “Boleh,” she replied as she pointed the payment terminal towards my phone screen that was plastered with a QR code. A beep confirmed the transaction and my purchase. This has become a norm for me—firing up an e-wallet app, in this case, the Touch ‘n Go eWallet app, clicking on “Pay” and making a purchase. I believe life can be simple, fast, easy; a two-click process.

If you’ve been following my cashless journey, well, I’ve been doing this cashless thing for a while. Call me an early adopter (and that would be true), call me a believer in technology (that’s also true), or call me insane (OK, suit yourself), but I think we’re living in interesting times.

I say that because…you see, in Malaysia, we’re pretty lucky. We’ve got considerably pervasive connectivity and mobile phone penetration, we’re well-served by the banking industry, and we’ve got a supportive government pushing a digital agenda.

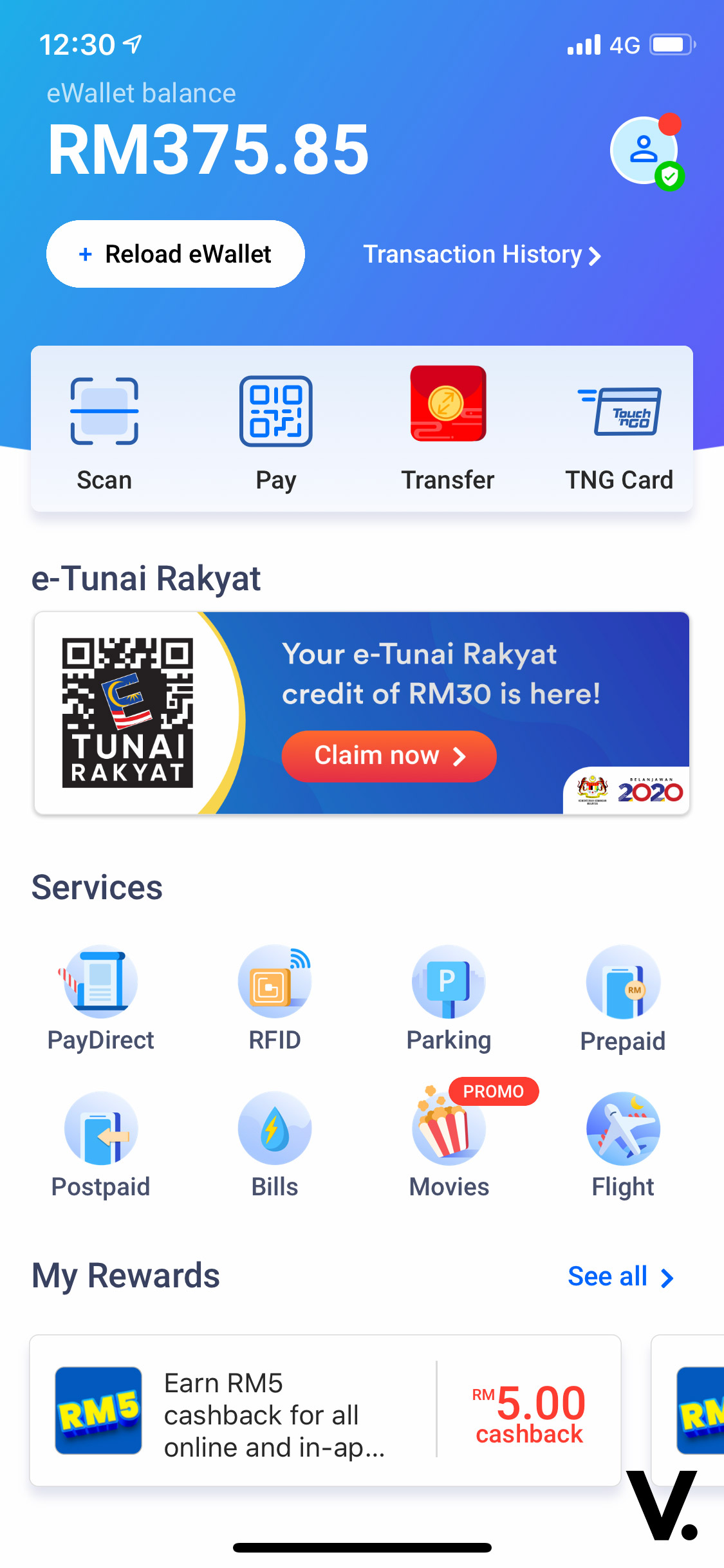

E-wallets have been a popular conversation piece lately, bolstered by the government’s ongoing MYR450 million e-Tunai Rakyat initiative that aims to spur digital payment adoption in the country.

It may be nascent days, but in just two years, there are already several clear leaders in the space; there’s Touch ‘n Go eWallet followed by Grab and Boost, in that order. All three are part of the e-Tunai Rakyat programme, handpicked for their user and merchant footprint.

Let’s not forget the other 39 e-money licensees (at last count) in the country who play their part in pushing the adoption of e-wallets. How about a round of applause, then?

Back in 2018, I did a 24-hour cashless challenge with Boost (and I survived!). I graduated to doing a seven-day cashless challenge with Grab late last year. While I admitted in the reviews that there were obvious gaps in the user experience, I found that things have improved for the better in the short span of two years. As a whole, it reaffirmed my conviction in the cashless future.

Sure, it’s not perfect. But let’s not get ahead of ourselves. The industry is still in its infancy and hiccups are expected. Rome wasn’t built in a day. And China, being the benchmark of a cashless society, has had a headstart.

OK, let’s not forget why we’re here. Touch ‘n Go eWallet threw me a challenge: to go cashless for five days with their e-wallet. There were no real rules except that I was encouraged to go about my day as realistically and as moderately as I could. This meant using my TNG eWallet credit to pay for my retail purchases, transport, food, and etc.

Touch ‘n Go would provide me with MYR500 credit for my five-day experience.

Disclaimer: While Touch ‘n Go eWallet has generously sponsored credits for this challenge, my opinions in this review are my own and are in no way influenced by Touch ‘n Go eWallet.

Here’s how it went.

The bread-and-butter

It’s nigh impossible to separate the Touch ‘n Go brand with mobility solutions i.e. Touch ‘n Go cards, tolls, public transport, parking. While the mother brand Touch ‘n Go and Touch ‘n Go eWallet operate as separate entities, their paths collide and overlap in more ways than one.

Take for instance toll payments and Touch ‘n Go cards. Since the early days of the Touch ‘n Go eWallet, you’re able to link up to three TNG cards to the TNG eWallet for easier manageability. The TNG eWallet later pushed this a little further, introducing PayDirect—a feature that enabled linked TNG cards to be used as a conduit for toll payments, while the actual transaction happens within the TNG eWallet.

We’ve yet to see this introduced with parking systems in buildings, but that day will come eventually I’m sure. They’re smart people, they’ll figure it out.

The other notable overlap is with TNG RFID. The contactless payment solution for tolls is…you guessed it—tied to your TNG eWallet.

I’m not sure if you remember this but TNG in partnership with Prasarana piloted a QR-code based payment system for the Kelana Jaya LRT line a while back. Unfortunately, this never saw a commercial rollout after the conclusion of the pilot. A shame.

So, toll payments are something I use TNG frequently for. I’m talking at least five trips per week via TNG RFID or SmarTAG where RFID isn’t supported.

By the way, TNG RFID will be available at all PLUS tolls come 1 April. Not an April Fools’ joke.

The no-brainers

Now, the no-brainers. I’ve mentioned these two earlier, playing to Touch ‘n Go eWallet’s core strength—mobility. TNG RFID and PayDirect are either/or options I use when I’m driving through tolled roads (supported ones, that is); there is no exception, or rather no other alternative. Throughout the five-day challenge, I found no hiccups nor any unexpected delays or errors using either channel.

The good

I know this isn’t an app review, but I’d like to give Touch ‘n Go eWallet some credit for rolling out a slick, intuitive app experience. Everything that you need is a click or two away. The app has improved by leaps and bounds since its early iterations. There are a couple of things that need to be improved, of course, and these I will touch on in the next section.

To make cashless retail payments is literally two clicks away. Reloading the e-wallet is automatic (because I’ve Auto Reload enabled), but even at instances when I need to reload manually, it doesn’t take more than two clicks.

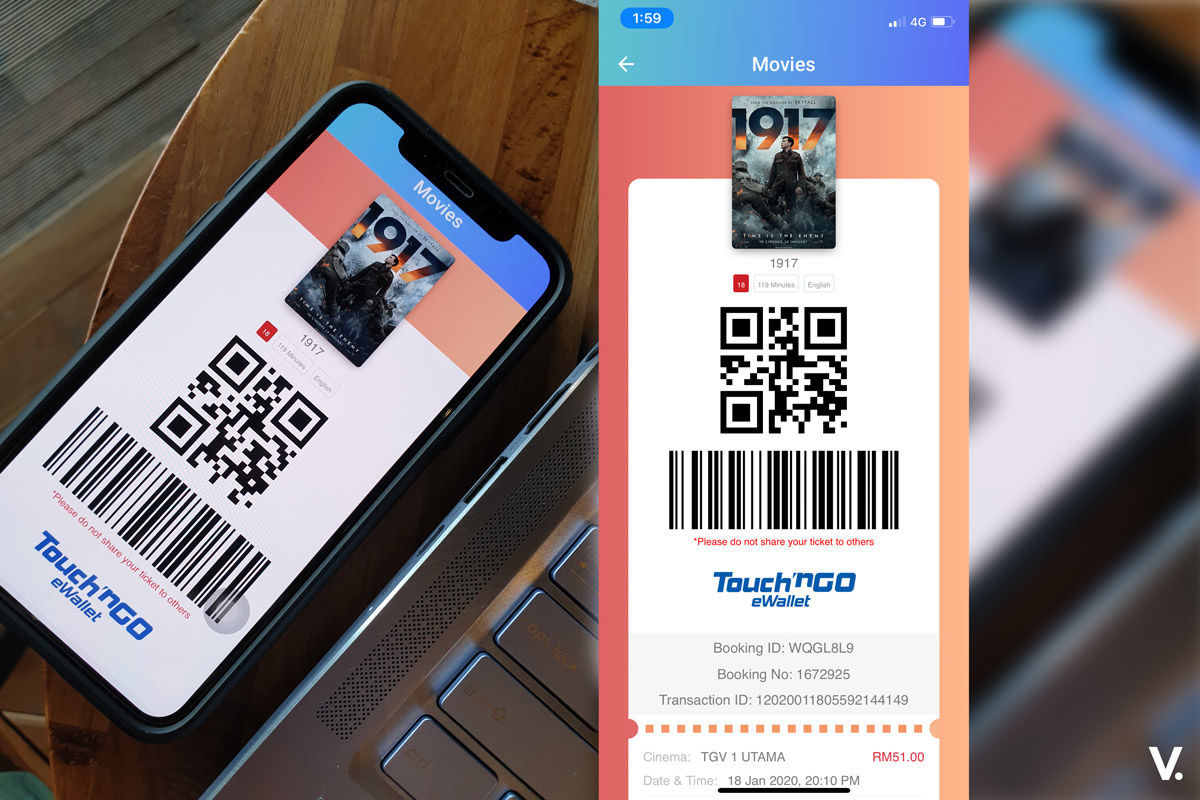

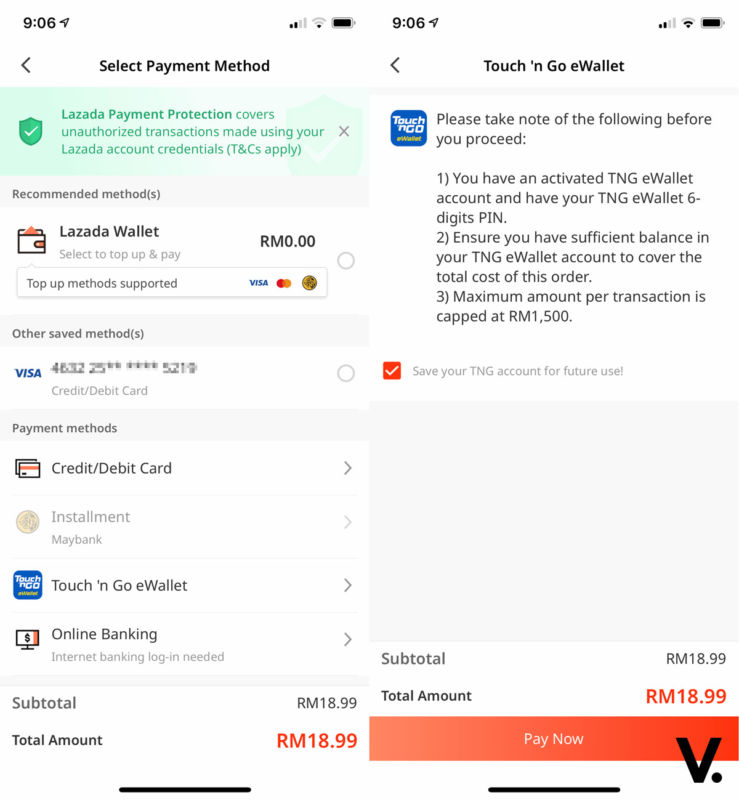

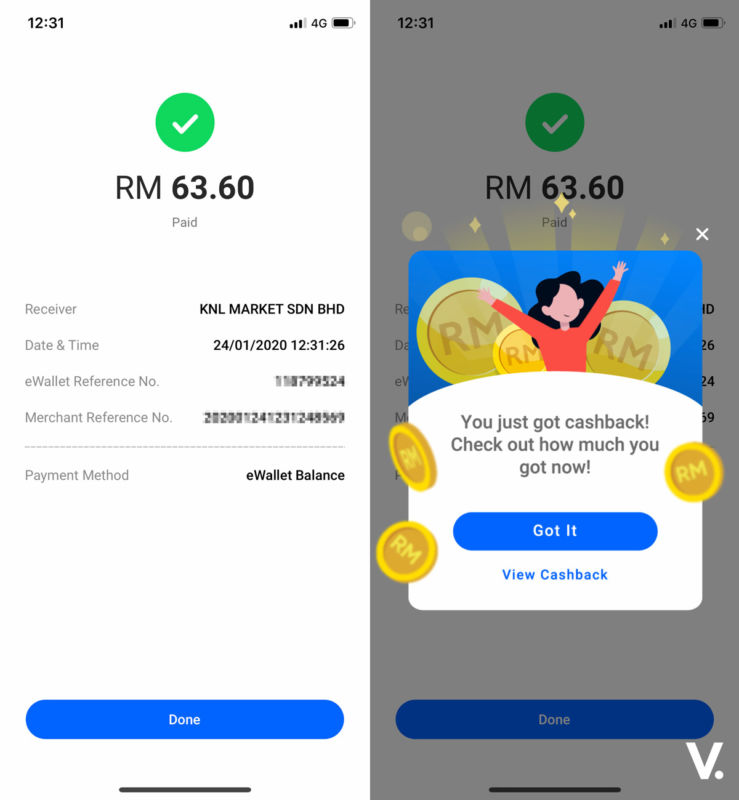

Over the course of five days, I did grocery shopping, I took advantage of a “Buy 1 Free 1” TeaLive offer, I bought movie tickets, I paid for several retail purchases and meals, I made an online purchase on Lazada, I paid for Apple Services, and a couple more. The fact that I could cover these many channels with just my smartphone and an e-wallet is pretty awesome.

Because there is a Jaya Grocer below where I live, I’m there often and most of the time, I’m armed with just my home keys, access card and smartphone. I can tell you that it’s liberating.

What’s encouraging is that the number of merchant touchpoints has vastly increased over the past six months. For Touch ‘n Go eWallet, the number stands at over 135,000 and growing. TNGD’s CEO Ignatius Ong said recently that he aims to have this number doubled this year. It’s also great that the platform isn’t just focused on big popular brands, but also the little mom and pop businesses and SMEs. I’m deeply impressed at what they’ve done in Penang—going on the ground and reaching out to hawker stalls and markets, democratising digital payments. I hope this is replicated in other states, fast.

An area where users will benefit from is the plethora of discounts and rewards available. Aside from merchants, Touch ‘n Go eWallet themselves offer cashback, rewards and more. Enjoy it while it lasts, as they say.

At the moment, the platform is running its BIG MYR2 Million Weekly Draw contest. Each e-wallet transaction earns you entries to a weekly draw that gives you a chance to win prizes such as the Proton X70, Yamaha Ego Solariz, Huawei P30 Pro, and more. It will run until 10 March 2020.

The bad

Expectedly, not everything is rosy. As with my experiences with the past two challenges with Grab and Boost, there are gaps in the experience. The number one problem is still accessibility and availability. I’m talking about the 135,001st vendor who’s not on board for whatever reason. Then, you’re forced to reach into your physical wallet that’s awkwardly in your pants pocket, sift through some soiled notes, count them and hand them to the cashier. Sometimes you get some soiled notes back, sometimes not.

Pervasiveness will take time to build, I get it. So, in the meantime, there needs to be a little planning involved or at least some prior background check before heading to a merchant or attempting to purchase something.

Which brings me to a glaring and rather irritating exclusion in the “discovery” department. Similar to the Grab app, there is no easy way to search for a merchant that accepts Touch ‘n Go eWallet payment. You will need to leave the app, head over to the TNG Digital website and scour the “Our Merchants” page for supported merchants. Or you may stumble upon a supported merchant at a physical location, its visibility aided by a “Pay with Touch ‘n Go” sticker or wobbler no less.

It’s a clunky experience and I’d like to see a location-based search function integrated into the app.

That aside, as with anything electronic, there’s always a risk of downtime—network latency, connectivity issues, the dreaded “system offline” problem, you name it.

Fortunately, it only happened once and this was at Nando’s when I attempted to settle my bill after my meal. As luck would have it, there was an unresolved network issue. In the end, a physical cash exchange ensued and I was disappointed more so than being annoyed.

The ugly

OK, so I was pulling your leg. There is no ugly.

In summary

After everything that’s said and done, I’m not the one who needs convincing about using e-wallets and embracing the cashless lifestyle. For me, it’s super easy-to-use, fast, convenient and secure. By going cashless, you’ll also be rewarded with various perks and discounts; with a concerted effort from the government and industry players, the experience can only get better.

I’m looking forward to a truly cashless future. It’s a question of “when,” not “if.”

Are you using an e-wallet? How has your experience been so far?