E-wallets and going cashless seem to be the conversation topics of the moment, thanks in part to the government’s ongoing e-Tunai Rakyat programme that aims to spur e-wallet adoption in the country. GrabPay, one of the leading e-wallets in Malaysia, has been growing from strength to strength since its introduction in 2018. It continues to expand its merchant footprint and use cases, making it easier for you and me to go cashless. So, can one go completely cashless? Well, Grab threw me a challenge to do just that recently.

The premise of the challenge is simple: I’m to go completely cashless for a week albeit encouraged to go about it realistically and moderately as I would on any normal day. This means using GrabPay credit to pay for any of Grab’s services including transport, food and delivery, online and offline payment, and even use GrabRewards points to redeem for rewards from the catalogue.

As part of the process, Grab would provide me with 1,000 GrabPay credits (MYR1,000) for my seven-day endeavour.

Disclaimer: While GrabPay has generously sponsored credits for this challenge, my opinions in this review are my own and are in no way influenced by Grab.

It’s not a new thing, at least for me

I consider myself an early adopter and as far as digital payments and e-wallets go, I’ve been doing this cashless thing for a while; for as much and as often as I can. Take a glance at my smartphone and you’ll see an entire folder dedicated to various cashless payment apps. You’ll find the usual suspects namely GrabPay, Touch ‘n Go, Boost, BigPay and Fave; to more obscure ones like GoPayz, Setel, RazerPay, and kiplePark. They’re there for different reasons and purposes. Perhaps one day we’ll have a true “super wallet” to rule them all.

In my physical wallet, I have a tonne of cards, too—from debit cards to Touch ‘n Go card, to lifestyle cards like Bonuslink.

To that end, it isn’t difficult to switch to a cashless lifestyle, at least for me. I’m not saying this as an early adopter. But it’s the fact that Malaysia is well banked. A large percentage of the population has bank accounts, hence also have ATM or debit cards. The concept of cashless shouldn’t be too foreign to many of us.

Answering the whys

Before I take you on my cashless journey with GrabPay, let me first try to convince you about this entire cashless reality. In a couple of salient points, I hope you’ll get me, and I hope you’ll get why I’m convinced that going cashless is the future. And I hope that you’ll embrace it, just as I have. I’m confident that it won’t replace cash entirely, at least not so soon. Physical cash, as a legal tender used for centuries, isn’t about to retire so easily. That said, what I’d like to see is the ratio between cashless and cash shifting. If the current cashless-to-cash ratio can be explained in the form of a pyramid with cash being at the bottom i.e majority; I’d like to see this pyramid flipped on its head.

So, here’s why.

We live in our smartphones. That’s not even metaphorical. And, I’m not just talking about trivial things like calls and messaging, but across the board–from communicating and organising our lives, to using it for entertainment and work. It’s literally an umbilical cord.

Our lives are mobile, always-on. And the umbilical cord statement perfectly describes the relationship between us and our devices. In short, they’re inseparable.

Which makes use cases like mobile payment i.e e-wallets viable and compelling. It makes perfect sense because the smartphone is something that’s always on you—in your pocket, or your handbag or in your hand.

It’s a natural extension of the mobile experience.

If I were to list three reasons on why e-wallets are great, I’d say: simple, fast and secure.

Need to pay for something? Fire up the app, and in less than three clicks, you’re done. Need to top up your e-wallet? With an already bonded debit/credit card (or via online banking), you can reload credit almost instantly. Some e-wallets like GrabPay also offer auto-top-up facilities once credit hits a certain pre-set threshold. Transactions are secure and tracked, hence easy to manage. And hey, there’s no need to scramble for change or queue at the ATM to withdraw cash.

For merchants and businesses, no cash transactions mean better manageability and reduced risk.

My GrabPay cashless adventure

If you’ve been paying attention, you would have noticed that I’ve switched gears from calling it a “journey” to an “adventure.” Ideally, this challenge would have been a piece of cake. Firstly, because I’m a believer. And that’s a battle half won.

Secondly, because of Grab’s killer bread-and-butter services that I already use almost on a daily basis. Finally, it’s the fact that its merchant footprint and use cases continue to expand.

Realistically, I was expecting gaps in the user experience—from availability and accessibility of services to occasional downtime due to factors like system or third-party connectivity issues. Caveat: These issues are not exclusive to Grab; they’re similar issues afflicting other e-wallet players as well. They’re issues I’ve come to accept that, through my experience with e-wallets thus far, things aren’t always perfect.

Now that we’ve gotten that out of the way…let the adventure begin.

The no-brainers

Who do you think of when it comes to e-hailing? Well, there used to be two clear go-to’s. Nowadays there’s the default option–GrabCar/GrabTaxi. Look, I wouldn’t be caught street hailing a taxi. And well, the competitors are just not there…yet.

Outside of this challenge, in a typical week, I’d be using Grab for rides and food delivery—rides almost on a daily basis and GrabFood delivery sometimes 3-4 times a week. I tend to use both Grab rides and public transport as often as I can especially during weekdays, despite owning a car (my wife and I share a car).

This saves time and hassle and also frees up the car for when my wife needs to use it. This routine more or less remained the same during the challenge, specifically during weekdays. The slight adjustment came during weekends when my wife and I would opt to take the ride-hailing option when we went out.

By the way, during the course of the challenge, I still had a monthly Grab Club “Grab-It-All-Lite” subscription, which gave me X amount of discounted rides (MYR3 off per ride) and free delivery (for GrabFood) per month. It’s sad that Grab has scrapped this subscription model; I do hope they bring it back soon.

If there’s a Grab service that has grown and matured nicely, it’s got to be GrabFood. As mentioned, GrabFood is also something I use a lot (my wife included). If we’re not out or cooking at home, we’d go the GrabFood route. This is for several reasons: the variety of cuisine/type of food, convenience and the buffet of promos which help save a pretty penny. In most cases, it’s cheaper than dining out and it saves time, and we can dine in the comfort of our own home.

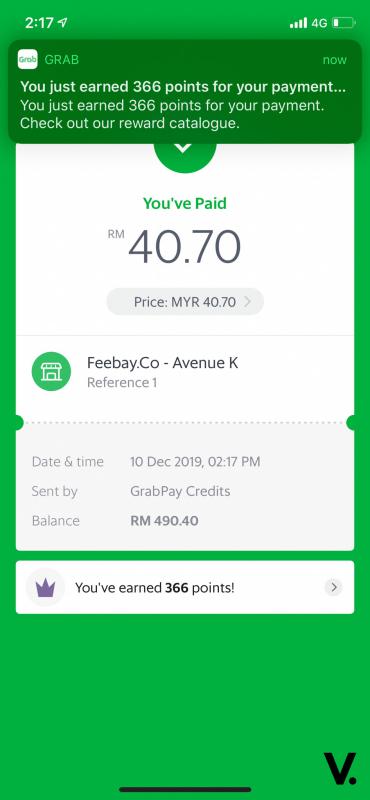

What’s also great is the GrabRewards system. Each GrabPay transaction gains you points. These points can be used to redeem for items or services offered in the GrabRewards catalogue. And recently, Grab also introduced the “Pay-with-Points” option that gives you another avenue to spend the points that you’ve earned.

Mind the gap(s)

It’s easy to see where Grab is good at—transportation, food delivery and of course, GrabPay and GrabRewards. Things become trickier when it comes to offline touchpoints. It does take some planning on your part. I say this because you’ll need to know if GrabPay is accepted at a particular merchant outlet. Sure, based on past experience I know some at the top of my head but at other times it’s either a stumble, a banner push within the Grab app or I’d have to head to the Grab website or Google for information. Besides visual cues from a POS display that GrabPay is accepted, there’s no easy way to know unless you’re onsite.

It’s one of the shortcomings of the Grab app. There needs to be a search bar to easily locate merchants. There need to be a “merchants near you” option to boost discoverability. I’m actually surprised why this feature is absent, seeing that GrabFood offers something similar.

I’ll give you a typical scenario. I’m at Mid Valley Megamall. Aside from Killer Gourmet Burgers (KGB), Tealive, MPH, Major Drop, Tesco and Watson’s, there’s no easy way for me to know (at least from the Grab app) if GrabPay is an accepted payment option at the outlet.

Which is the perfect segue to the next question: availability. It’s not unlike the debate we have with our telcos: speed vs coverage, costs vs speed, etc.

With e-wallet providers, it tends to be about rebates/discount vs availability (coverage). How do you decide on which platform to use? Is it because the provider gives you plenty of cashback or discounts? Or is it because you can use it more widely?

Granted, coverage and availability will take time to build. Already, e-wallet providers such as Grab have aggressively expanded touchpoints. As it stands, GrabPay has over 25,000 touchpoints across the country which are selected and curated based on users’ favourite everyday brands. I’d like to see more, please. Thank you, Grab.

Side challenges

As part of the seven-day challenge, Grab also threw me other side challenges or scenarios for me to complete: plan a date night out (dinner and entertainment); buy groceries to prep lunch for several days, or buy a gift for a loved one or myself. I had to pick two.

Since my wife and I tend to cook as often as we can, buying groceries is something we do regularly, both online and offline. It also helps that we have a Jaya Grocer supermarket below where we live. For the sake of the challenge though, I ordered a bunch of stuff from AEON BiG, the nearest being the Mid Valley outlet. The selection isn’t extensive but I did manage to stock up on garlic, carrots, tomatoes and some greens. The ordering process and delivery were glitch-free.

So, date night was dinner and a movie (we love catching up on the latest films on the weekend). GrabPay is accepted only at MBO currently, so I decided to take us to the Atria Mall in PJ. Disappointingly, for some reason, there was a payment issue with GrabPay at MBO, when I tried to buy tickets. The lady at the sales counter shrugged it off as a system issue and we left annoyed and disappointed. The first thing I did was to tweet Grab Support about my experience. They later replied that there were no known issues with GrabPay at MBO, possibly an MBO-specific system issue.

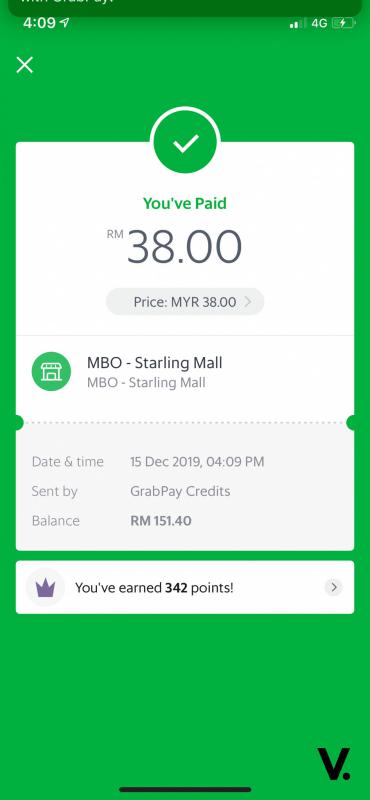

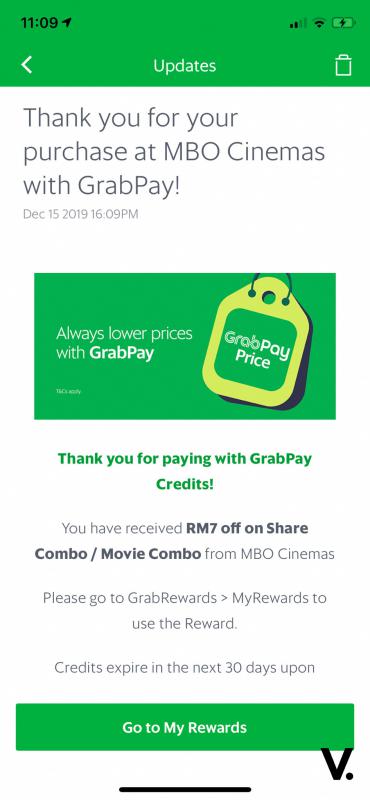

Back to the drawing board, I went. We decided to give The Starling Mall a shot the next day. Let’s hope this works, I thought. And “Frozen 2” had just opened. What better date movie than “Frozen 2” right? Thankfully, I encountered no payment issues this time around and for the record, we enjoyed the sequel! (I didn’t like the first “Frozen” film). Dinner was at Lim Fried Chicken, one of the local favourites located at the Foodies Nest on Level 3 of the mall.

Other little things

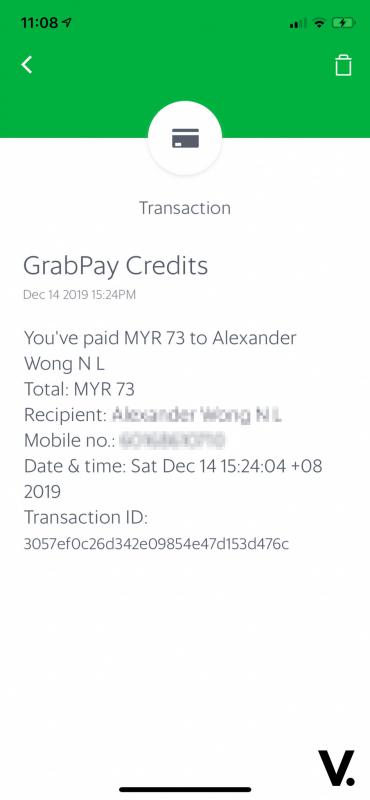

Aside from paying for transport, food delivery and retail purchases, GrabPay is handy when you have meals with friends or colleagues. Why? When you “go Dutch,” it’s easy to settle the bill and pay dues. Again, no need to carry a wad of cash, or scramble for change. A couple of clicks is all it takes to transfer funds.

Better days ahead

The cashless challenge reaffirmed several of my own convictions about the cashless future. Like it or not, e-wallets and the cashless lifestyle are here to stay. Yes, we’re only at the tip of the iceberg, but with a cohesive push by the government and industry players like Grab, that reality is inevitable. Going cashless has its benefits. It’s easy-to-use, convenient, fast and secure, and as we’ve seen from Grab and other e-wallet providers, you can save money through the plethora of rewards and discounts, too.

Perhaps completely replacing cash is far-fetched at this point. That said, there’s no reason why the pyramid can’t be tipped.

If you remain unconvinced about going cashless, ask yourself this question: “How much cashback did you receive for using cash today?”

I can’t wait for the day that I can leave home with just my smartphone. Let’s hope we won’t have too long to wait.