With the resignation of its Acting Group CEO Datuk Bazlan Osman last week, Telekom Malaysia is on the search for someone permanent to steer the ship. Word has it that Astro Malaysia Holdings Bhd Group CEO Datuk Rohana Rozhan is one of the top candidates for the seat.

Rohana is one of three external candidates being considered since the resignation of Datuk Seri Mohammed Shazalli Ramly back in June.

As you may know, Rohana resigned as Astro Group CEO in June, and will vacate the post in 31 January 2019. She will remain on the company board as Non-Executive Director.

During her tenure, Astro’s customer base grew multiple fold from two million to 5.5 million.

According to NSTP, one of two “internal” candidates also considered for the CEO post is TM’s Chief Strategy Officer Dr Farid Mohamed Sani.

Bazlan says no

Datuk Bazlan Osman reportedly declined an offer from TM’s board for the job before stepping down as AGCEO. Bazlan also resigned as a TM Executive Director, which takes effect on 28 February 2019.

His departure comes at a challenging time for the telecommunications giant.

New guy but not for long

The hot seat is currently occupied by Imri Mokhtar, as AGCEO and COO. Prior to his new role as AGCEO, Imri was the Executive Vice President of unifi, responsible for the end-to-end management of the converged portfolio comprising phone, broadband, mobile, TV, wifi and value-added services for TM’s home and SME customers.

With increased competition and evolving market dynamics, TM revised its revenue growth target earlier this year, to negative 1.0% to flat in 2018, originally set at 3.5-4.0%.

As part of its transformative journey, the company announced new unifi plans including an entry-level plan as well as turbocharged broadband plans that boost speeds by up to 10X.

The industry shaking move spurred rivals TIME and Maxis to respond with new competitive plans.

Rough waters

Recently, the company was involved in a spate of fiery public exchanges with Gobind Singh Deo, the minister of Communications and Multimedia, who accused the company for not doing enough for its Streamyx customers.

The latest is that both parties will work together to iron out Streamyx issues.

It will take more than hope and sunshine to reverse TM’s fortunes, but let’s see if Rohana can bring a new dimension to the group. If she takes the helm, that is.

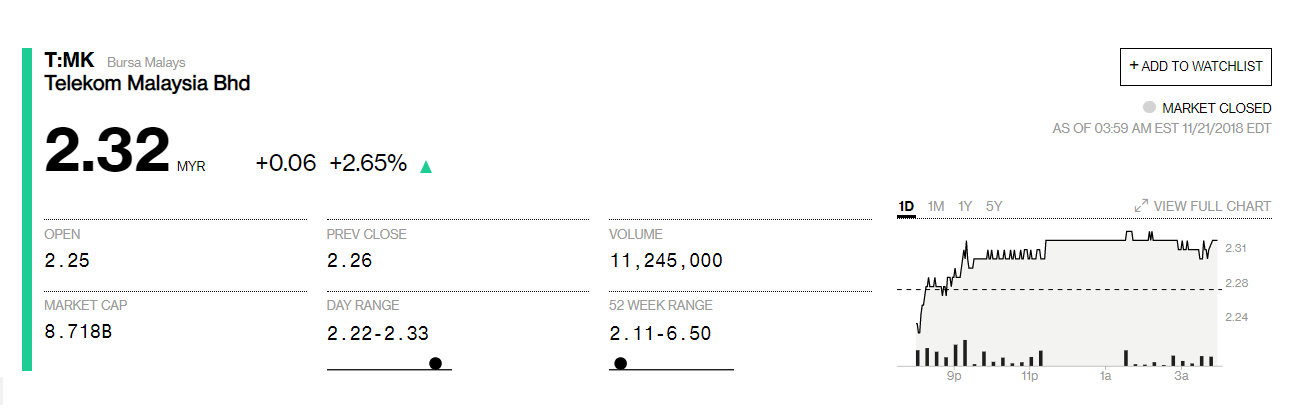

As of press time, TM shares blipped upwards by 2.6% to MYR2.32 per share, from a five-year low of MYR2.22 per share.

Source: NSTP VIA SoyaCincau