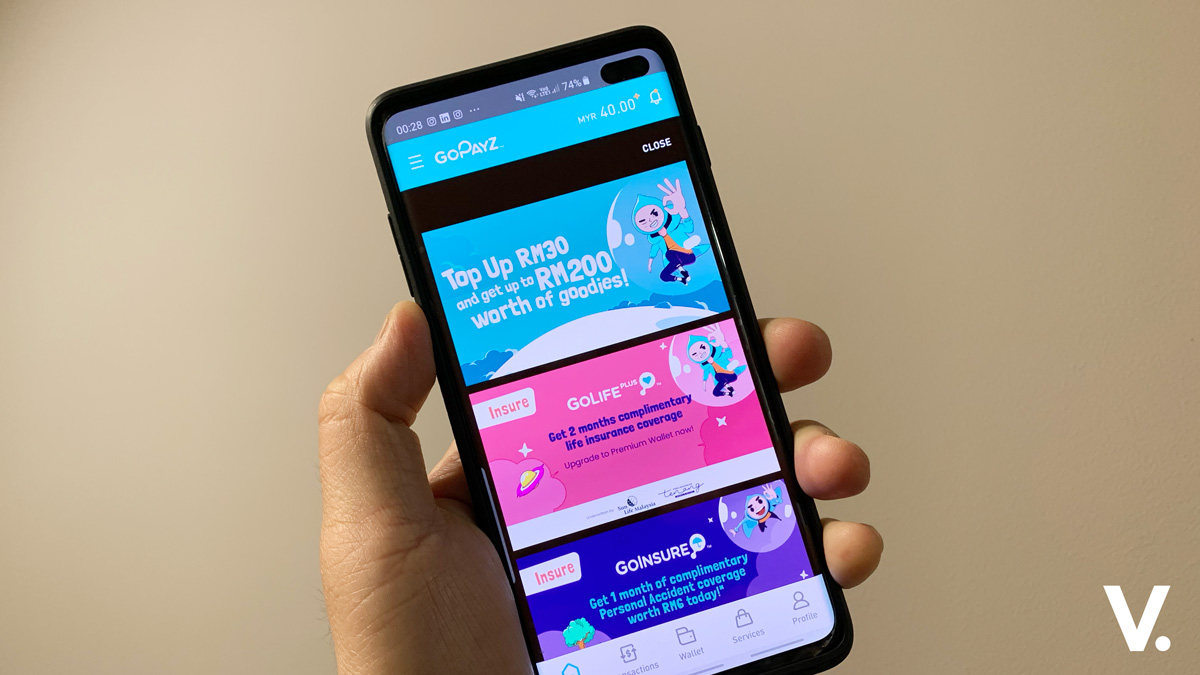

To celebrate the launch of GoPayz, U Mobile is running the GoPayz Top-Up Campaign from 1 November until 31 December 2019. GoPayz is rewarding customers who top up at least MYR30 into their GoPayz wallet during the campaign period with MYR200 worth of goodies.

The goodies include:

- 1x free GoPayz physical card (which otherwise costs a shambolic MYR16 per card)

- 2x months complimentary GoLife Plus life insurance

- MYR6 cashback with purchase of GoInsure PA insurance

- MYR30 cashback with any unit trust investment of MYR1,000

- Discounts and promos from select GoPayz partners

Additionally, U Mobile customers who top up at least MYR30 will enjoy additional perks like free movie tickets and drinks.

U Mobile first announced GoPayz alongside GoBiz in June this year–its foray into the fintech industry. The two platforms are part of its strategy to build a comprehensive fintech ecosystem to offer affordable digital financial services to consumers and businesses.

So, what makes GoPayz different from other e-wallets?

GoPayz is a universal e-wallet that focuses on offering digital financial products and lifestyle services to consumers. The e-wallet is naturally driven by a mobile app that offers several virtual debit cards—UnionPay, Mastercard and Visa. As an option, users can also request for a physical card (offered at MYR16 per card). This is similar to what is being offered by competitors like BigPay or MerchantTrade MTAMoney.

But here’s where GoPayz is different. The platform offers digital financial and wealth products and services. For example, you can buy micro insurance products like GoLife Plus from as low as MYR13 per month, with a coverage of up to MYR76,000. Seeing that over 50 percent of Malaysians are uninsured, this is a great step to treat the underserved. Or you can make unit trust investments via GoPayz’s partnership with FSMOne.

Its e-wallet is also different. Unlike local players like Touch ’n Go (Boost just tied up with UnionPay), GoPayz can be used to make payments anywhere locally or overseas. This is thanks through partnerships with all major card scheme network merchants like Mastercard, UnionPay, Visa, and soon, JCB.

Because it’s app and online-based, GoPayz can be accessed anytime, anywhere.

Sign-up is free but note that the e-wallet needs to keep a minimum balance of MYR10 at all times for any forex fluctuations. The MYR10 will be refunded if you close your GoPayz account.

A basic GoPayz account has a maximum wallet size of MYR2,999. You can upgrade your wallet by going through a KYC (Know Your Customer) process and enjoy an upgraded MYR5,000 e-wallet limit. It may take up to two working days for the upgrade. Note that you’ll need an upgraded wallet to request for a physical card, as well.

For more information about GoPayz and the top-up campaign, visit www.gopayz.com.my.

Latest news

- “Unlimited” Data with Limits? Demystifying Telco Fair Usage Policies (FUP) in Malaysia

- Get Ready for 2024: The Rise of Generative AI in Cyberattacks

- Acer unveils the Predator Triton 16

- Refreshed Acer Swift Edge 16 Laptop set to shine with 3.2K OLED display

- Never miss a World Cup Qatar 2022 match with Astro Fibre

Subscribe to Vernonchan.com: Never miss a story, read stories on Feedly and Medium

Disclosure: Keep in mind that VERNONCHAN.COM may receive commissions when you click our links and make purchases. Clicking on these links cost you nothing and it helps to cover some of the costs for the upkeep of the site. While we may receive commissions, this does not impact our reviews, views and opinions which remain independent, fair, and balanced. Thank you for your support.