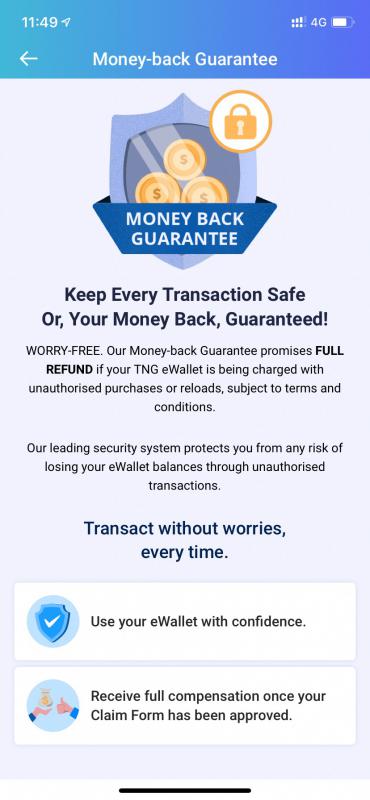

Touch ‘n Go eWallet today announced a Money-back Guarantee Policy—the first-ever safety and security policy for mobile payment in Malaysia. The move is part of the company’s efforts to ensure users are safe and secure at all times, and at the same time quash any concerns about security when using digital mobile payment.

The first-of-its-kind policy was revealed at the “Cashless Confidential: eWallet vs Cash” Which is More Secure?” forum hosted by TNG Digital Sdn Bhd, in collaboration with Nielsen Malaysia.

The forum panelists consisted of Syahrunizam Samsudin, CEO of TNG Digital; Teh Huey Tzi, chief risk officer of TNG Digital; Arslan Ashraf, managing director, consumer insights – East zone, The Nielsen Company; Ibrahimn Sani, lead business editor and executive producer, Astro AWANI; and moderated by Julian Ng, CEO of Main Street Capital.

At the forum, Nielsen Malaysia highlighted that one of the key concerns among consumers on e-wallets surrounds the aspects of safety and security. Based on Nielsen study, 46 percent of Malaysians are concerned about security measures and fraud risks related to digital payment.

Additionally, Malaysians are fearful about using e-wallets due to security concerns involving payment and banking details, data breach, as well as malware and software issues.

Malaysians still prefer to pay in cash for regular everyday expenses like buying groceries or dining out.

Some 38 percent of Malaysians fear of missing transactions or monies when making digital payments. Also, 30 percent are afraid that their mobile phones are stolen to make purchases. In terms of breach of data, 39 percent are worried that their banking details may be leaked to a third party.

Teh Huey Tzi, chief risk officer at TNG Digital lamented, “Consumers today expect convenience and security to go hand-in-hand with mobile payments and that’s exactly what we are enabling with the Money-back Guarantee Policy.”

“Apart from multi-factor authentication process, our backend system also applies Artificial Intelligence (AI) and machine learning that works to detect anomalies and mitigate any potential unauthorised activities. We are easing their transition in adopting and embracing a fully digital lifestyle by removing their doubts on security when they transact using our e-wallet.”

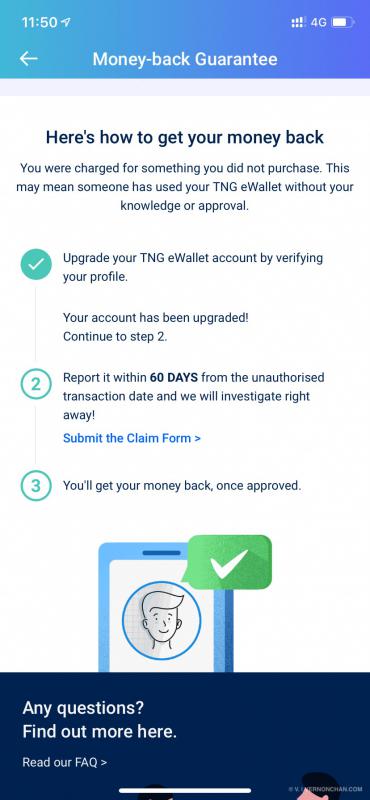

The Money-back Gurantee Policy covers all verified eWallet users. To verify, follow the Account Verification process (eKYC process) within the app. Once verified, the Money-back Guarantee protection will be activated with an eWallet protection shield icon on the user’s profile button.

A user can report any unauthorised transactions and request for compensation directly from the eWallet app or by visiting the website https://tngd.my/mbg.

Users will be prompted to fill a form with details of their case and attach proof of receipts or relevant document related to the transaction. The eWallet team will investigate and if claims are proven to be legitimate, refunds will be processed and reimbursements will be made within five working days.

To date, Touch ‘n Go eWallet has over 4.2 million users and over 50,000 acceptance points.

If you haven’t already, download the Touch ‘n Go eWallet app for Android and iOS.