Telekom Malaysia Berhad (TM) today announced that it was revising its Headline Key Performance Indicators (KPIs) citing evolving market dynamics and a challenging operational environment. The group also stated that the implementation of its transformative Performance Improvement Programme 2018 (PIP 2018) is now in its fourth wave. As detailed in a previous post, TM also revealed new broadband plans that are part of ongoing efforts to democratise broadband in the nation.

It’s been a challenging year for TM, with intensifying competition, increasing business and operating costs, cautious enterprise spending and increasing regulatory pressure. As if not enough, it also lost its CEO.

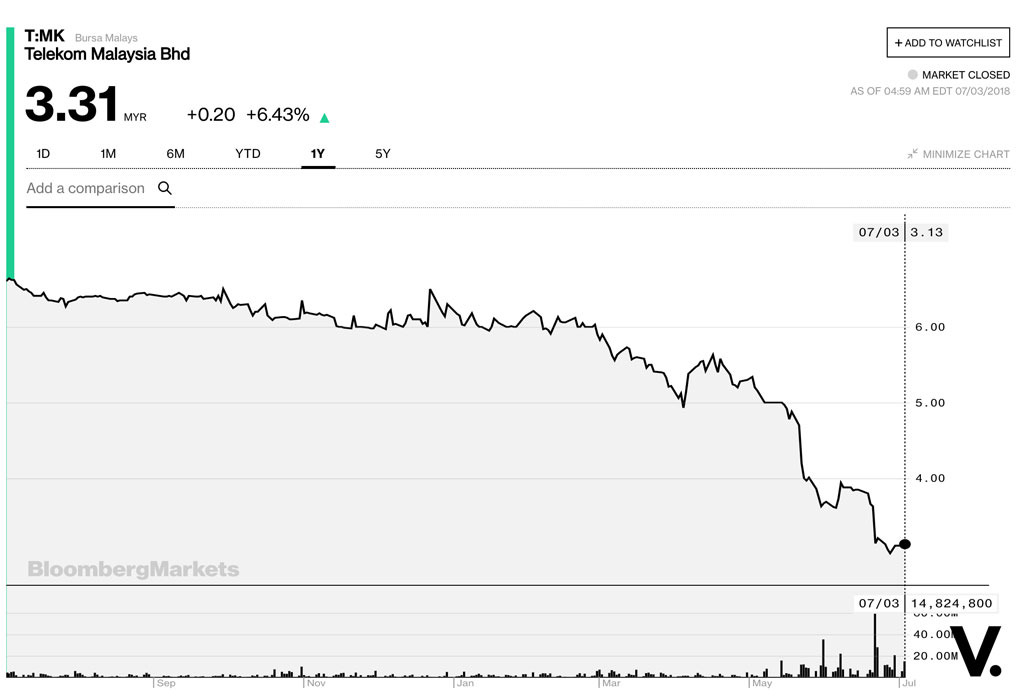

Downtrend

As a quick recap of Q12018, the group’s revenue fell 4 percent, down from MYR2.9 billion to MYR2.85 billion compared to the year-ago quarter. Its Q12018 Normalised Earnings Before Interest and Tax (EBIT) dropped 29.6 percent, from MYR311.9 million to MYR219.7 million. The group’s net profit declined 32 percent, down from MYR230.4 million to MYR157.1 million for Q12018.

TM’s share prices has also taken a tumble in the past 12 months – a 43 percent decline.

Datuk Bazlan Osman, TM’s acting group chief executive officer said the group expects these headwinds to persist this year, and thus it’s revising its KPIs for 2018.

So, can Malaysia’s convergence champion take it by the horns, continue to be resilient and stay competitive?

Adapting to change

For starters, TM is revising its revenue growth. Originally set at 3.5% to 4.0% based on the previous year, the group is revising it to negative 1.0% to flat in 2018.

Group Operating Profit (EBIT) is set at approximately MYR1 billion, while Customer Satisfaction Measure is 72, downwards from 74 in 2017.

The global average for Customer Satisfaction Measure is 68.

Additionally, capital expenditure (capex) guidance for the year has been revised to between 20% and 22%, from the high 20s% guided earlier in the year.

TM said that its capex entails reprioritising its network spending and sweating of existing assets.

So, does lowering expectations mean lower goals? What do shareholders and analysts have to say about this?

Transforming from inside out

Well, this is where TM’s strategic initiatives come in. Having embarked on a transformation journey back in 2006, the 34-year old telecommunications giant continues its efforts to adapt to the ever-changing landscape.

Through its Performance Improvement Programme 2018 (PIP 2018), now in its fourth wave, it hopes to build upon the foundation that will accelerate its current plans of convergence and digital.

There are four main pillars to PIP 2018: Revenue Uplift, Sustained Profitability, Improved Cash Flow and Increased Productivity.

According to TM, a dedicated PMO team has been established to closely track and monitor the execution of the programme.

Turbocharging broadband

In terms of product offerings, TM introduced new unifi plans today as it continues to attempt to increase the percentage of convergence households. It’s rolling out a new entry-level plan targeted at the B40 segment, priced below MYR100.

It is also doubling the speed for existing customers with no additional cost. Current Streamyx (pre-unifi) subscribers that are within unifi locations will be offered special upgrade packages.

For a more detailed drill down, read this previous post.

TM’s share price jumped by 11 sen to MYR3.22 (3.5%) after its announcement and closed at MYR3.31 (up 6.43%). Its share price is close to its lowest level in 52 weeks, with a peak of MYR6.69.

For more information, visit www.tm.com.my.