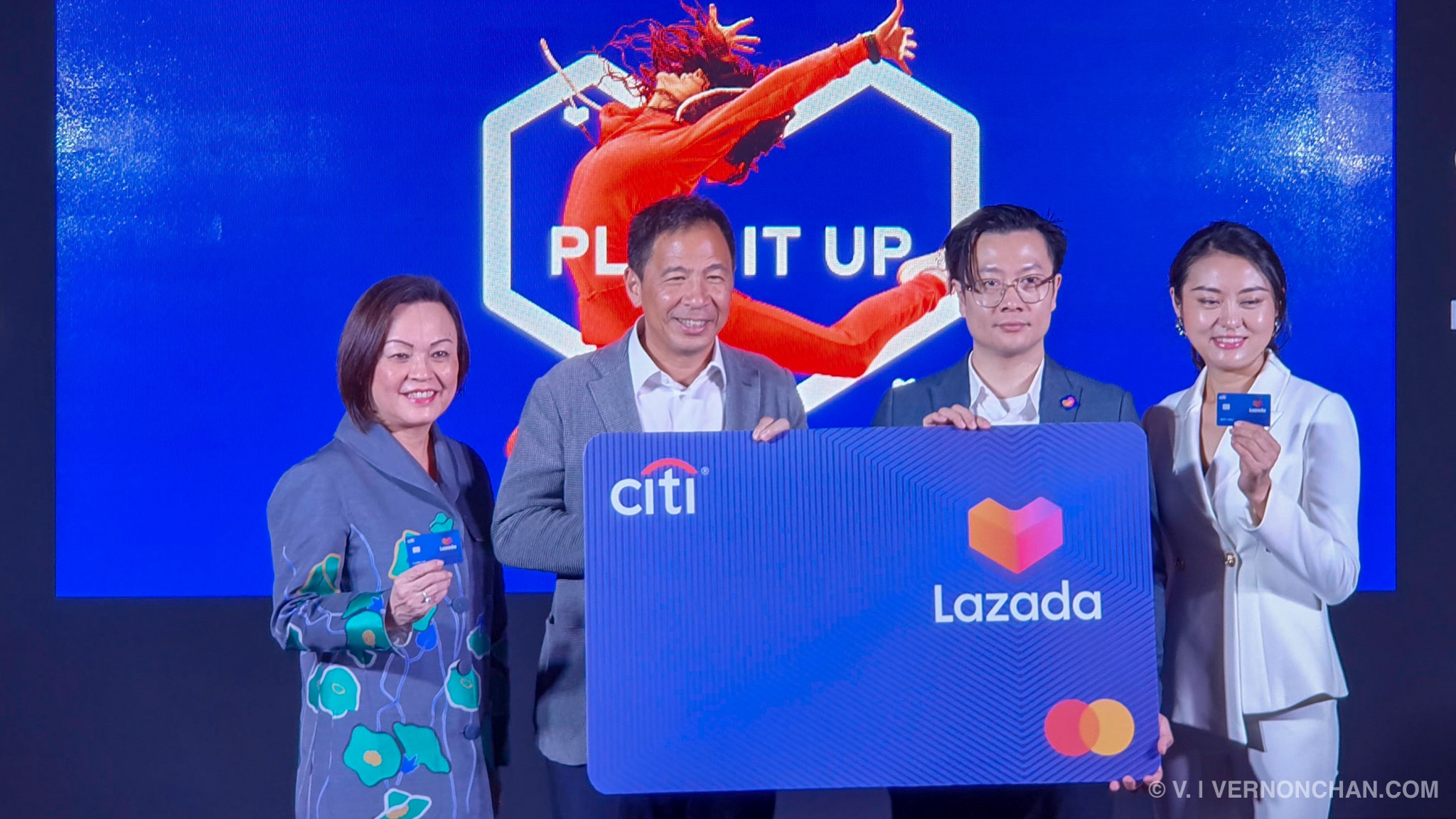

Two big-wig brands, Citi and Lazada Group today announced the launch of the new Lazada Citi credit card—the first e-commerce co-brand credit card in the region. Now available in Malaysia the credit card will be rolled out to other markets in the region over the next six months.

So, is it yet another credit card?

Short answer: Yes and no. Targeted at the digitally-savvy millennial generation who make up the majority of e-commerce customers in the region, the credit card is still fundamentally a credit card. Typical requirements include being at least 18 years of age, with a base income of MYR36,000 per year; credit limit will depend on income.

Where the Lazada Citi credit card is different is several prong. For the first time ever, cardholders will get to earn 10x rewards points on Lazada purchases and 20 percent cashback on Lazada Wallet top-ups. Additionally, you can save more by using points earned to offset Lazada spending. What’s more, you stand to earn 1,000 points every month by using the card for all your retail purchases with a minimum retail spend of MYR1,500 per statement month.

That’s not all. This card is also packed with unique travel, wellness and lifestyle benefits and discounts from selected partners such as Malindo, Klook, Fraser Hospitality, Domino’s, Healthland and ClassPass. You’ll be able to earn 5x points when you spend with these partners. Also, new card applicants will receive up to MYR500 Lazada vouchers when they apply online.

Citi and Lazada are confident of the new product and are targeting over 500,000 sign-ups of the new card across the region over the next few years.

The co-brand card is a natural extension to Citi and Lazada’s long-standing partnership which dates back to 2016.

For Lazada, who serve around 1/3 of the Malaysian population, tapping into Citi’s global footprint helps widen its breadth of offers and services. Citi’s Asia Pacific Consumer Banking business has around 15.2 million credit cards, covering 12 markets in Asia Pacific and five in EMEA.

According to Citi, over half of new credit card and loan acquisitions are generated digitally today—a more than 2x increase in the last three years.