As expected, Apple on Monday announced Apple TV+ — its new TV and video streaming service, the rumoured Apple News+ news subscription service, as well as Apple Arcade–its new video game subscription service. It also announced Apple Card, a credit card that ties with Apple Pay.

With the debut of Apple TV+, the Cupertino company goes head on with existing big players like Netflix, Hulu, Amazon Prime, and others. It’s a crowded space with Disney set to launch its digital streaming service this year as well.

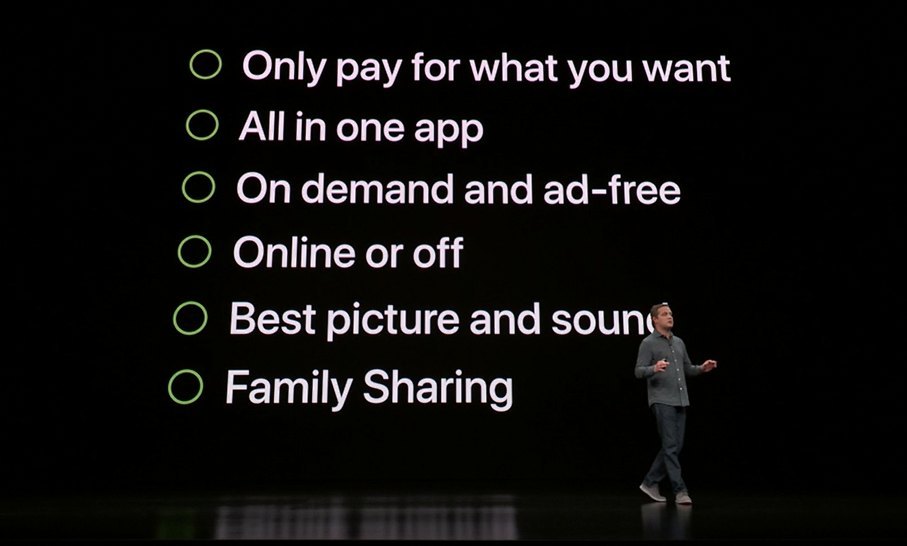

Apple TV+ offers some existing cable, satellite and streaming video services such as Hulu, HBO and Showtime. The service will kick off in May; it will let users pay for their favourite channels within the Apple TV+ app and like Netflix, allow them to download to watch offline.

No pricing was announced.

Apple TV+ will feature a brand new slate of programming from the world’s most celebrated creative artists, including Oprah Winfrey, Steven Spielberg, Jennifer Aniston, Reese Witherspoon, Octavia Spencer, J.J. Abrams, Jason Momoa, M. Night Shyamalan, Jon M. Chu and more.

Rumours were rife regarding a news subscription service and sure enough Apple announced a read-all-you-can USD9.99-per-month news subscription service called Apple News+. The new service offers more than 300 magazines, including The New Yorker, Sports Illustrated, Wired and Food & Wine, and news publications including the Los Angeles Times, The Wall Street Journal and theSkimm, a newsletter.

Apple says the news app doesn’t allow advertisers to track users and what users read will not follow you across the web. Nice to know.

That aside, the company also introduced Apple Arcade—a video game subscription which will offer over 100 games to start, with more to come.

Apple’s big push into services comes as no surprise. With declining sales of the iPhone and Mac hardware, Apple’s Services category will become a key contributor to the company’s bottom line. In 2018, services generated over USD10 billion in revenue, representing 14 percent of Apple’s overall revenue. iPhone sales, as a comparison contributes 63 percent.

Perhaps a surprise announcement at the event was the debut of Apple Card—a virtual credit card in partnership with Goldman Sachs and MasterCard. The credit card is closely integrated with Apple Pay and iOS’ Wallet app. Where Apple Pay isn’t accepted, users can opt for a physical card.

What’s special about the card? No hidden fees, transaction fees and yearly fees. And users will her daily 2 percent cash back on all purchases as well as 3 percent on Apple purchases. In terms of security, the card number is stored in a secure enclave on-chip on the iPhone and dynamically generates for transactions.