Apple continues its big push into the services category with the introduction of several new services including Apple TV+ (video streaming subscription), Apple News+ (news/magazine subscription), and Apple Arcade (video game subscription) on Monday. The massive surprise, and a masterstroke I might add, is Apple Card—its very own credit card in partnership with Goldman Sachs and Mastercard.

Designed in California

First, it looks astonishingly minimalistic, chic, elegant. And as Apple describes it: “It represents all the things Apple stands for. Like simplicity, transparency, and privacy.”

I think I may be going overboard here, in an absolutely fanboy sort of way, but the card is beautiful. It’s made of titanium, with a laser-etched Apple logo and cardholder’s name and security chip on the front. Yes, that’s it. No card number. On the back, it’s just the Goldman Sachs and Mastercard logo etched at the opposite ends, at the top of the card. No magnetic strip, no CVV.

It’s the world’s first titanium card, so it’s thin and light, nothing you’ve seen before.

It’s the world’s first titanium card, so it’s thin and light, nothing you’ve seen before.

Speaking of which, Apple chose to work with Goldman Sachs, which the company says “were open to doing things in a whole new way.” Apple Card is Goldman Sach’s first ever consumer credit card they’ve issued.

In typical Apple fashion, the “hardware” (i.e Apple Card) fully integrates with software and the Apple ecosystem. Virtually, the Apple Card is securely stored and accessible on your iPhone via the Wallet. This means you don’t actually need a physical card if a retailer supports Apple Pay. That said, who wouldn’t want a physical Apple Card? It’s gorgeous.

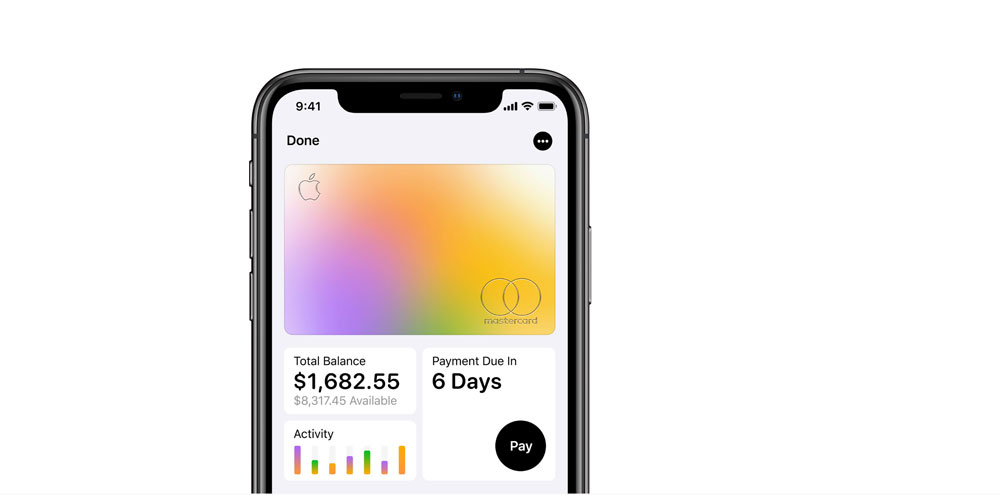

Now, on the software side of things, the Apple Wallet details everything–from your current balance; it logs and analyses your spending activity and even reminds you of payment due.

Everything you spend on is categorised and assigned a colour; you can simply tap for a weekly or even monthly summary of your expenses.

Because it logs everything, in the case of you wondering where you charged your card at, Apple Card uses Maps to pinpoint the location.

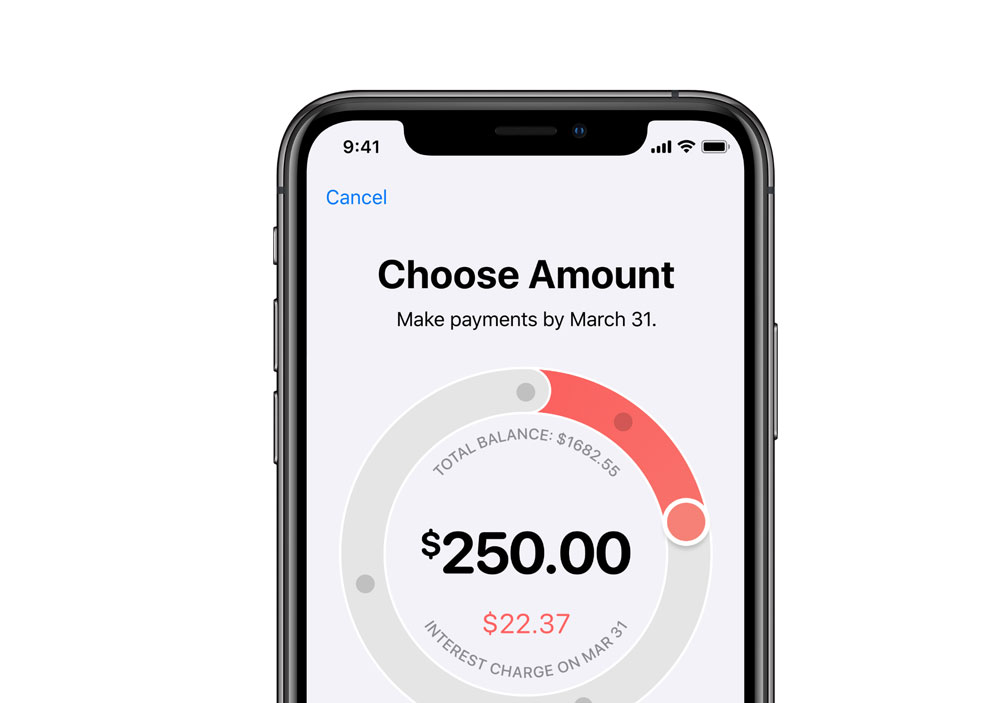

What’s also cool is that the app shows you the best way to save on interest payments when you can’t pay your balance in full each month. Apple Card does the math for you and even offers smart payment suggestions to encourage you to pay more to pay off your balance faster.

What’s also cool is that the app shows you the best way to save on interest payments when you can’t pay your balance in full each month. Apple Card does the math for you and even offers smart payment suggestions to encourage you to pay more to pay off your balance faster.

The user interface and user experience are intuitive and simple, as it should be.

Apple being a strong proponent of security and data privacy ensures your Apple Card experience is protected and secure. You’ll get an instant notification each time you buy something. Apple Card will notify you of any unusual or suspicious activity.

And speaking of security, when you first get your Apple Card, your iPhone generates a unique device number and this is tucked away in the Secure Element. Each purchase requires the device number along with a one-time, dynamic security code that your iPhone generates to authorise a purchase. To authenticate a purchase simply use the Face ID or Touch ID.

With all that said, here are the real sweeteners.

Apple gives back

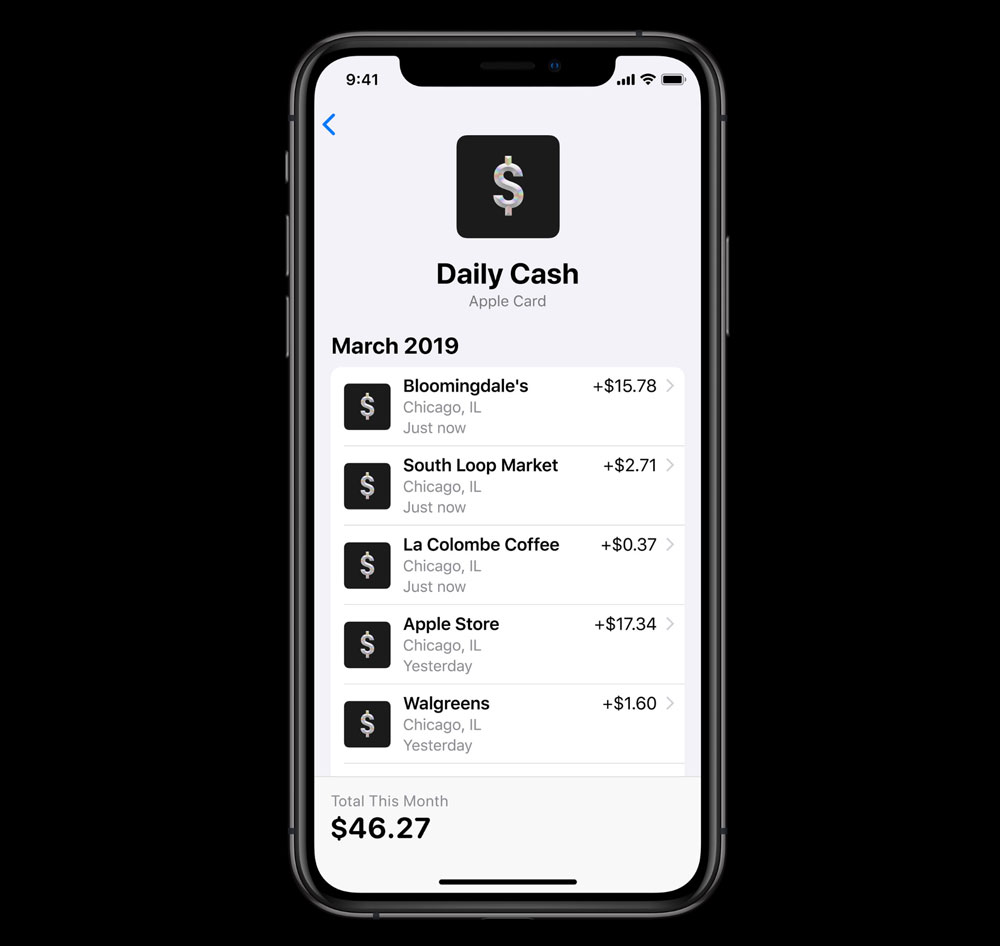

Apple Card gives you Daily Cash (that’s cash back) daily on every purchase you make—that’s 2% back every time you use Apple Pay. No limits. Whether it’s groceries at Walmart or a Lyft ride. In case you shop in a store that doesn’t support Apple Pay yet, you’ll still get 1% cash back when you use the physical Apple Card.

The icing on the cake: 3% cash back on everything you buy from Apple—this includes from the Apple Store, apple.com, App Store, or iTunes; services like Apple Music and iCloud storage.

Importantly, Apple Card does not have fees. Yes, you read that right. No annual fees. No cash advance fees. No international fees. No over-the-limit or returned-payment fees and absolutely no hidden fees. How’s that possible?

Well, since it’s a credit card, it will be based on creditworthiness, and if you’re on the wrong side of that, you wouldn’t have qualified for the card in the first place. And based on your credit standing, APRs range from 13.24% to 24.24%, which are competitive rates.

Apple will not charge penalty rates, but any late or missed payments will result in accrued interest toward your balance.

A slab of metal, a stroke of genius

Having said all that, thanks for paying attention, here’s why I think the Apple Card is brilliant.

Number one: status. Just like a Platinum Card, Apple Card exudes a certain level of prestige.

Number two: scarcity. Somewhat related to my first point–scarcity breeds desirability; and just because not everyone will qualify to get an Apple Card, and even if they did, they’d need to own an iPhone. Worse still if you’re in Malaysia, you’ll like never get one.

Number three: easy to spend. Cash back is fantastic motivation for people to spend more. In Apple’s case, there’s every incentive to buy Apple goods and services with Apple Card and Apple Pay due to the attractive cash back.

Number four: it builds loyalty. Already, Apple users and fans tend to be a loyal bunch. Apple Card is status symbol, payment platform and reward system all rolled into one, encouraging users to stay in the ecosystem.

Number five: it grows Apple Pay. Apple cleverly incentivises users to use Apple Pay not just to buy Apple goods and services but literally everything else. This bodes well for the Apple Pay platform as it drives adoption and usage.

Apple reinvents the credit card (cliché, I know)

OK, so there’s nothing exciting about a credit card, especially in the era of digital payments, e-wallets and such. But Apple’s genius here is creating an enticing (and great looking) package that keeps money within its ecosystem and users locked in.

Apple Card is coming in summer 2019, in the US. For more info, visit Apple.com.

What do you think of the Apple Card?

https://www.youtube.com/watch?v=HAZiE9NtRfs