Tencent Inc.’s WeChat has announced the official launch of payment features of its mobile payment solution WeChat Pay MY – in Malaysia. The mobile payment solution integrates fully with WeChat’s ecosystem and will enable local businesses to engage with customers throughout their shopping journey.

WeChat Pay MY will allow you to make payment and transfer money in Malaysian Ringgit (MYR) within the WeChat app. This covers a host of daily online and offline payment needs – from peer-to-peer transfers, to paying merchants like telcos, airlines, bus ticket providers, restaurants, retail stores, and more.

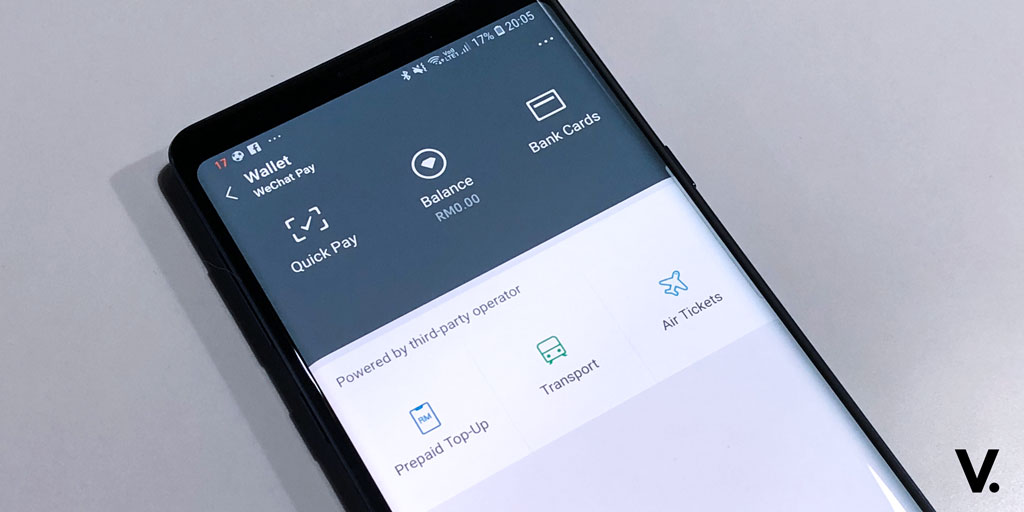

The function can be found under the “Wallet” in the “Me” section within the app.

Here are seven key things you need to know about WeChat Pay MY:

Quick Pay: The “Quick Pay” function lets you make payment easily and quickly. Simply show the generated QR code to the merchant to scan and enter the payment pin to complete the transaction. KK Supermart is the first chain store in Malaysia to accept WeChat Pay MY. The store also recently tied up with Boost to offer cashless payment in-store.

Debit card binding: To top up your WeChat Pay MY e-wallet, you can bind your Mastercard or Visa debit cards issued by local banks. You can bind any number of debit cards to a WeChat account, but the same debit card can only be bound to one WeChat account.

Money Packet: This is a social payment function where you can make peer-to-peer transactions with friends and family on the WeChat network. There are two types of Money Packets: Individual Money Packet and Group Money Packet.

In conjunction with the launch, Money Packets of a random amount ranging from MYR3.88 to MYR88.88. In addition to that, a prepaid top-up coupon of MYR2 will be given away to all WeChat Pay MY users from 21 August until 28 August 2018.

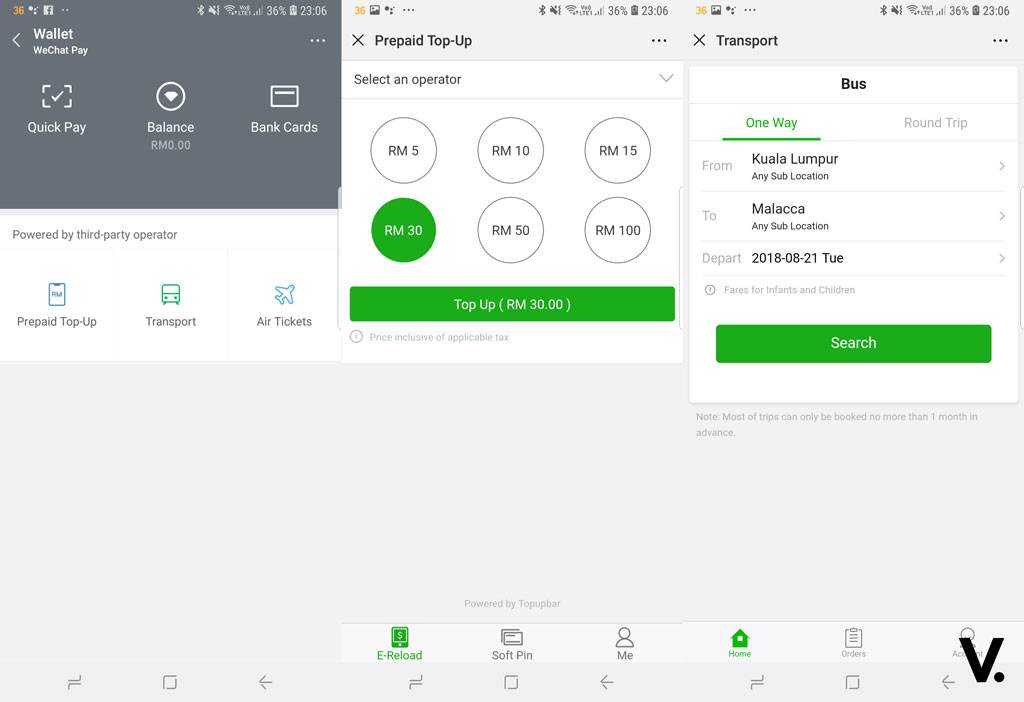

Prepaid top-up: WeChat Pay MY lets you top up your mobile prepaid accounts. This includes telcos like Altel, Celcom, Digi, Friendi, Maxis, Merchantrade, Tune Talk, U Mobile and XOX.

Bus and airline ticket purchase: You can purchase bus and airline tickets directly from the app, and you can even select seats through a third-party bus and airline ticket service provider.

Wallet balance withdrawal: You can withdraw the balance in you WeChat Pay MY e-wallet at any time to your own bank accounts in Malaysia. The withdrawal limit is set at MYR10,000 per calendar month. Withdrawal limits per wallet account and per bank account is MYR4,500. For Android devices, cumulative daily payment and withdrawal limit is MYR1,000, as per Bank Negara Malaysia security guidelines.

Security: WeChat assures that its payment system complies with international standards, and it carries out 24/7 real-time monitoring on all transactions made through its monitoring system. Users are required by default to enter a 6-digit payment password for authorisation before payment. All user-related information is stored locally in compliance with Payment Card Industry Data Security Standard (PCIDSS). Also, WeChat Pay cannot be used on jailbroken or rooted smartphones.

Malaysia is the first country outside of China to use WeChat Pay services. With a pool of 20 million WeChat users, it’s not a surprise the company picked Malaysia as its first expansion market.

WeChat Pay MY has a trio of merchant acquirer partners namely Hong Leong Bank, iPay88 and Revenue Monster.

The mobile payment solution joins a growing list of e-wallet solutions in Malaysia including GrabPay, Boost, Razer Pay, Kiple/KiplePark, Touch ‘n Go, just to name a few.

Download WeChat for Android and iOS.

For more updates on WeChat Pay, visit www.facebook.com/WeChatPayMY.official/