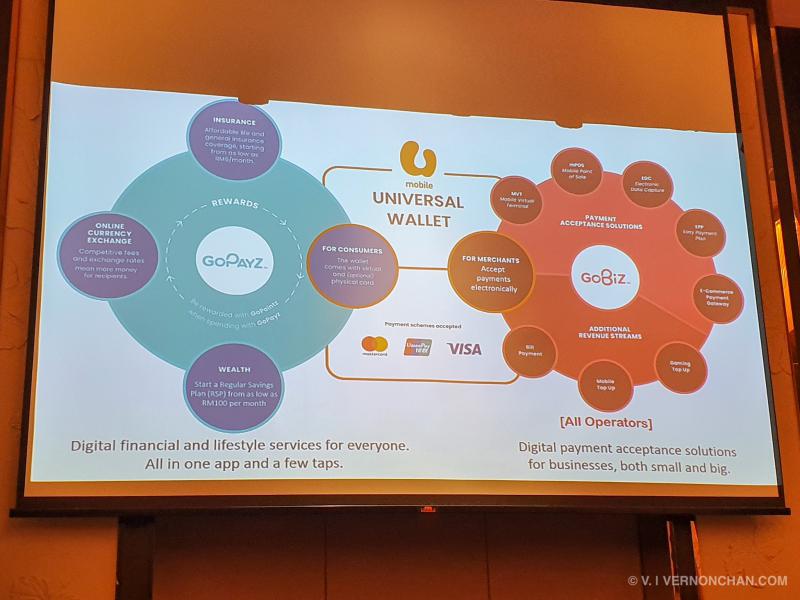

U Mobile today takes on the fintech industry with two distinct platforms: GoPayz and GoBiz. The comprehensive fintech ecosystem is expected to roll out this July, awaiting final approval from Bank Negara Malaysia (BNM).

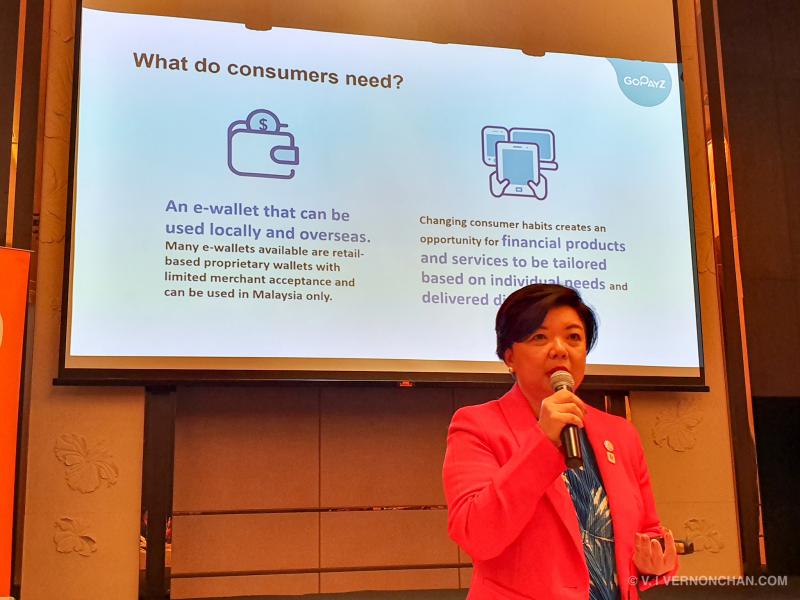

“We’re not building (just) an e-wallet. We’re building an ecosystem,” said Jasmine Lee, Chief Marketing Officer of U Mobile during the media briefing. “With GoPayz, we can now offer affordable digital financial services to everyone,” she continued. U Mobile aims to make fintech services a lot more accessible, affordable and inclusive.

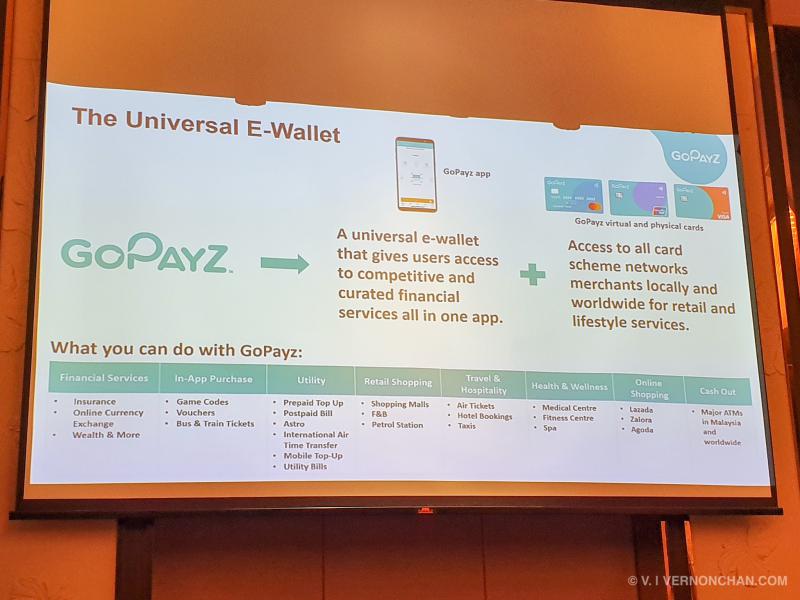

GoPayz: Not just another e-wallet

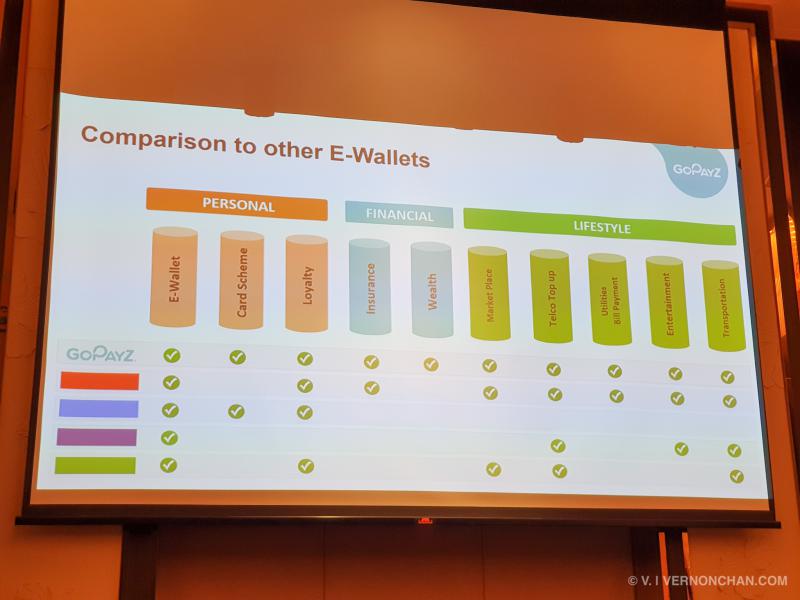

GoPayz is a universal e-wallet offering digital financial and lifestyle services targeting consumers. The e-wallet is driven by a mobile app that offers a virtual debit card, as well as an optional physical card. It’s no different than how rivals BigPay or MerchantTrade MTAMoney operate.

That said, GoPayz offers distinct features, focusing on digital financial and wealth products not offered on other platforms. For instance, you can buy the micro insurance product GoLife Plus premiums from as low as MYR13 per month, with a coverage of up to MYR76,000.

U Mobile is taking the term “universal e-wallet” seriously too, because unlike local players like Boost, Touch ‘n Go or even sibling e-wallet RazerPay, GoPayz can be used to make payments anywhere locally and overseas. Many local e-wallets are retail-based proprietary wallets and can be used in Malaysia only. This is done through all card scheme network merchants like MasterCard, UnionPay, and Visa, and in the future, JCB.

Being mobile app-driven, customers can perform everything at their convenience, without having to visit a bank or go through agents.

Just like any other e-wallet, you can reload via online banking as well as credit/debit cards. I was told that the maximum e-wallet size is MYR5,000, substantially bigger other e-wallets (BigPay and MerchantTrade still lead with MYR10,000 limit).

GoPayz also offers a rewards/loyalty program where you can earn GoPointz loyalty points from various transactions.

U Mobile assured that bank-grade security and fraud detection features are in place to ensure all personal information and payment transactions are encrypted and protected 24/7. The telco also stressed that while GoPayz and GoBiz are U Mobile products, personal data is not shared between the new fintech products and U Mobile.

With GoPayz, customers can look forward to using it for shopping on- and offline, buy insurance and financial services, make telco top-ups, pay for bills, buy game codes, pay for bus, plain and train tickets, and also withdraw cash at major ATMs in Malaysia and overseas. ATM withdrawals are charged MYR1 per transaction locally and up to MYR10 overseas.

Being within the same “family,” GoPayz users can also make payment at all 10,000 Razer Pay payment points (7-Eleven, Starbucks, Krispy Kreme, etc).

GoPayz even offers online currency exchange through an partnership with MaxMoney, where you can buy foreign currency in-app, then have the cash personally delivered to you within three hours.

GoBiz: Enabling businesses

With GoBiz, U Mobile aims to solve several business pain points including the cost of setting up POS, long approval processes and digitisation. The platform seeks to enable all business—big and small, to accept payments from customers and also offer additional revenue-generating services.

GoBiz makes it easy for merchants to sign up; the approval process only taken within three days.

The platform offers a wide range of payment acceptance solutions—from mobile point-of-sale (mPOS), KIOSK, EDC, to mobile virtual terminal (MVT). U Mobile has partnered MasterCard, UnionPay and Visa to give merchants the flexibility of accepting payments from local and international customers.

GoBiz also give merchants opt-in for additional revenue-generating services such as telco prepaid top-ups, bill payments and even game points to customers.

The service is open for registration starting tomorrow.

GoPayz and GoBiz will available commercially in July 2019. For more information, visit www.gopayz.com.my and www.gobiz.com.my.