With PayNet’s DuitNow, it is now possible to receive money instantly and securely using your mobile phone or MyKad. As of now, 14 banks support DuitNow and an additional 17 banks and non-banks will soon be onboard, as well.

DuitNow is a real-time online fund transfer service that allows you to transfer funds to your recipient’s DuitNow ID instead of their bank account number. This is an industry wide initiative among all banks to simplify fund transfers.

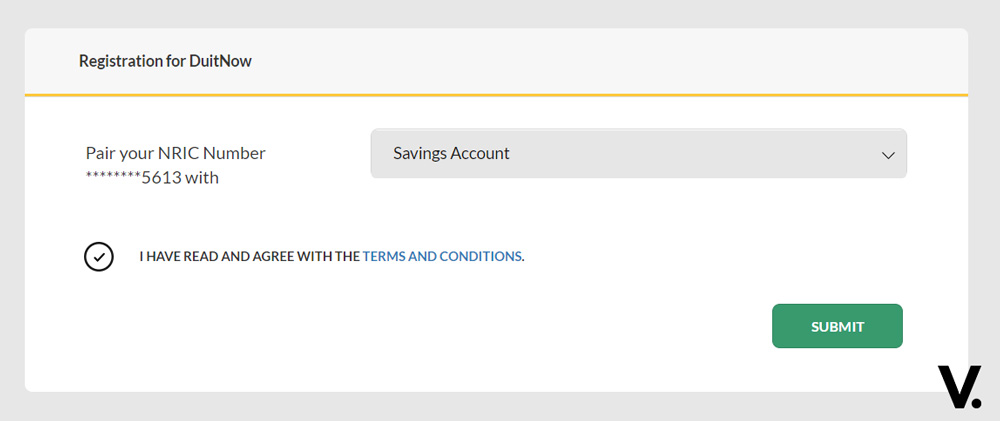

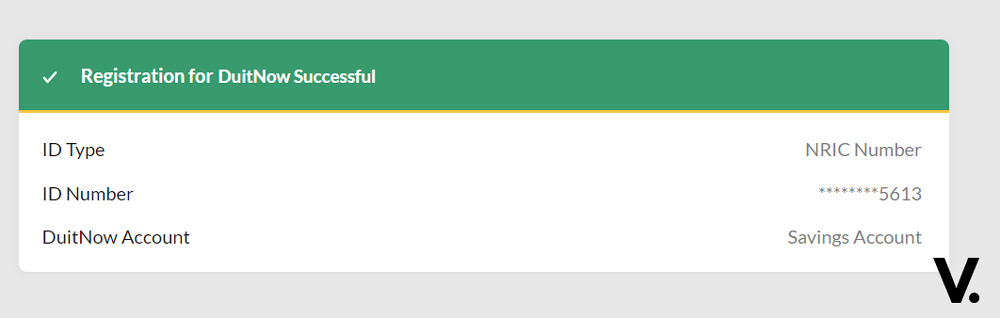

Your DuitNow ID is simply a unique identifier that is used to register your account number. You can register one DuitNow ID to one account e.g. your mobile number to your Savings account, or your NRIC to you current account.

To start receiving DuitNow fund transfers using your mobile number, all you need to do is perform a simple one-time registration to link your mobile number to your bank account. You may also link your MyKad or MyPR Identity Card numbers, Army or Police numbers, Passport numbers or Business Registration numbers to your bank account.

However, registration is not required to send money via DuitNow.

Now you can view, modify or transfer your DuitNow registrations via 14 bank’s internet or mobile banking channels.

Now you can view, modify or transfer your DuitNow registrations via 14 bank’s internet or mobile banking channels.

PayNet says an additional 17 banks and non-banks will soon join the fray. This includes participating e-money apps.

Transfers up to MYR5,000 are free, although some banks are also offering free for transfers above MYR5,000. Consumers may transfer up to MYR50,000 per transaction at banks, and businesses may transfer up to MYR10,000,000 per transaction at banks. Note that limits may vary according to your bank.

In conjunction with DuitNow’s launch, there’s will be a nationwide contest with prizes worth millions of ringgit for bank customers who have registered with DuitNow, starting 8 January 2018.

For more information, visit http://www.duitnow.my