United Overseas Bank (Malaysia) Bhd (UOB Malaysia) has announced a cash rebate campaign to encourage more of its customers to go contactless. The campaign is open to all new customers who open a savings or current account with UOB Malaysia from now until 15 January 2019.

When you top up your WeChat Pay MY e-wallet for the first time using your UOB debit card, you’ll receive a MYR50 rebate. There’s a caveat: you’ll need to credit in MYR5,000 within a month of the opening of your account, then maintain an minimum average monthly deposit balance of the same amount, then top up at least MYR50 into your WeChat Pay MY e-wallet. This offer is on a first-come-first-served basis.

UOB Malaysia says contactless payments have grown by 113 percent in the past 12 months, as customers use contactless payments like wave-and-pay over traditional chip and pin payments. Wave-and-pay transactions in 2017 grew three times more compared to the year before.

[irp]

Mobile payments are also increasing. Payments made on UOB Mighty Pay, the payment system within the bank’s all-in-one mobile banking app, are growing at an average rate of 26 percent a month since November 2017.

Additionally, UOB Malaysia customers can enjoy Americano coffees at just MYR1 at Starbucks outlets nationwide when they pay with WeChat Pay MY e-wallets. This offer is valid from now until 25 November 2018.

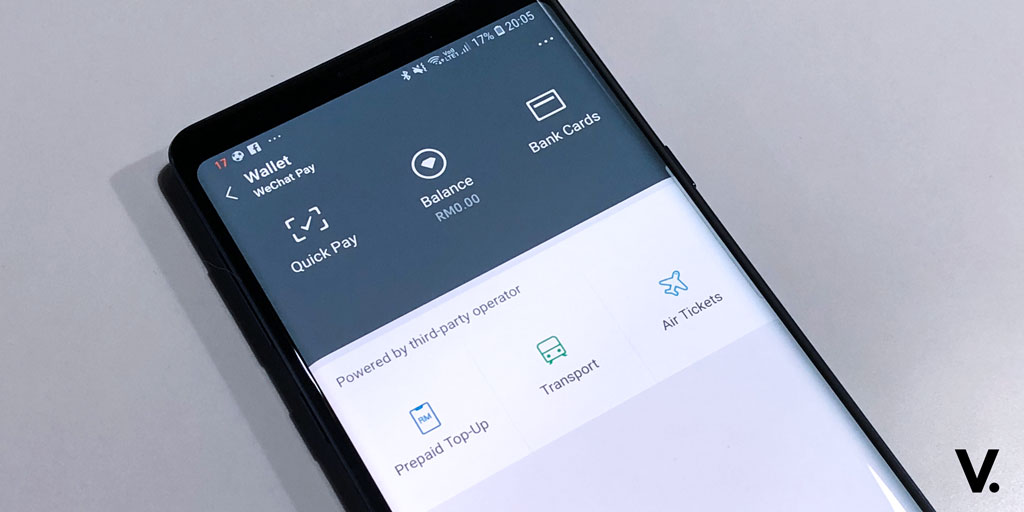

Tencent Inc’s WeChat launched the payment feature of its mobile payment solution WeChat Pay MY in Malaysia back in August 2018. The mobile payment solution lets you make payment and transfer money in Malaysian Ringgit (MYR) within the WeChat app.

Here’s seven things you need to know about WeChat Pay MY.