President Trump’s new tariff policies are reshaping the tech industry, with increased taxes on electronics imports affecting smartphone and device prices.

“To me, the most beautiful word in the dictionary is tariff, and it’s my favorite word”

Donald Trump, 2024

When you woke up this morning, you probably checked your smartphone, maybe fired up your laptop, or asked your smart speaker about the weather. What you might not have considered is how the price and availability of these everyday tech companions are changing under the expanded tariff policies implemented since January 2025.

The tech industry—globally interconnected by nature—now finds itself navigating an economic reshuffling that will eventually make its way to consumers’ wallets. This article examines how these policy changes are affecting everything from manufacturing decisions to retail prices.

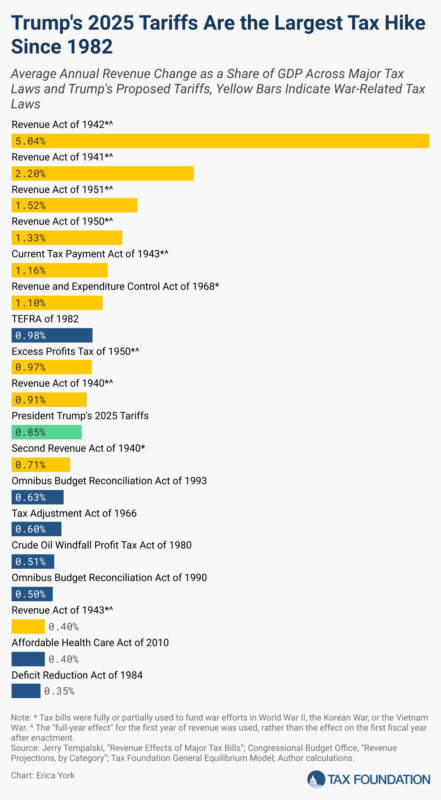

Understanding Tariff Basics

A tariff is essentially a tax imposed on imported goods. When a shipment of smartphones arrives at a U.S. port from China with a 25% tariff, the importer must pay the government 25% of the value of those phones before they can be sold domestically.

Tariffs serve multiple purposes:

- Revenue generation for the government

- Protection of domestic industries from foreign competition

- Leverage in international trade negotiations

- Addressing perceived unfair trade practices

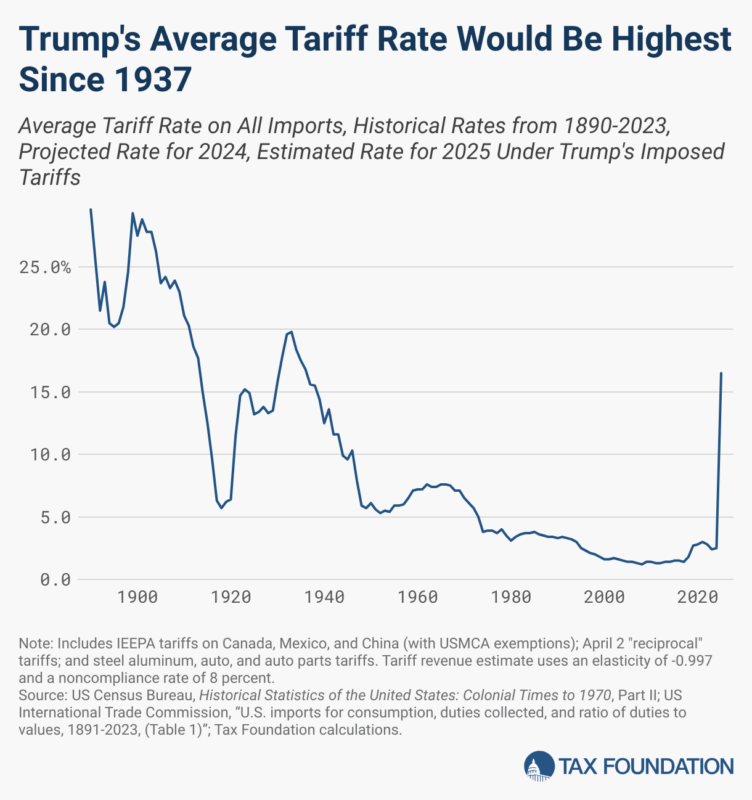

Historical context is important: Average U.S. tariff rates were around 1.6% across all products during the 2010-2016 period, among the lowest in American history. The first Trump administration (2017-2021) marked a significant shift, with rates increasing to roughly 3% at their peak. Current estimates suggest effective tariff rates in 2025 are reaching approximately 5% across all goods—the highest in decades.

For tech specifically, the category that once enjoyed nearly tariff-free status now faces rates ranging from 20-35% on many components and finished goods.

The Current Policy Landscape

The administration has implemented several key tariff policies affecting technology:

- Increased tariffs on Chinese electronics from 25% to 35% on components and finished goods

- New 20% tariffs on previously exempt semiconductor components

- Expanded tariffs to include tech imports from Vietnam and other Southeast Asian nations where companies had relocated to avoid previous China-focused tariffs

- Special focus on batteries and rare earth minerals critical for everything from EVs to smartphones

These measures appear designed specifically to reshape global tech manufacturing patterns. According to economic analyses from multiple institutions, tariffs collected represent revenue for the government, but the costs are largely borne by American businesses and consumers rather than foreign exporters.

The iPhone Effect: Understanding Tariff Impact Through America’s Iconic Product

To understand how these tariffs work in practice, let’s look at America’s most iconic tech product: the iPhone.

Despite efforts to diversify manufacturing bases in recent years, significant portions of iPhone assembly and component sourcing still occur in China. The 35% tariff on Chinese electronics creates a profound dilemma for smartphone manufacturers.

Let’s break down what happens with a premium smartphone like the iPhone 16 Pro:

Based on industry analyst estimates, the components and assembly might cost approximately $550. Under the current tariff structure, this would require an additional $192.50 per device in tariffs for units manufactured in China—a substantial increase representing about 19% of the typical $999 retail price.

Companies face three challenging options: absorb the tariff cost and accept lower margins, pass the costs to consumers through price increases, or accelerate their already complex supply chain diversification—likely some combination of all three.

Industry reporting indicates that major smartphone manufacturers are pursuing mixed approaches, with hints of “pricing adjustments in select markets” alongside “accelerated supply chain realignment initiatives” that could cost billions in the short term.

How Tech Companies Are Responding

For tech giants and startups alike, the tariffs create a complex calculus of costs, manufacturing decisions, and pricing strategies.

Major tech companies had already begun diversifying manufacturing beyond China in recent years. According to industry analyses, approximately 30% of Apple’s supply chain remained in China entering 2025, requiring significant adjustments in response to the new tariff environment.

For smaller companies without vast resources, the challenges are even greater. Hardware startups face manufacturing cost increases of 20-35%, creating serious financial pressures at a time when venture capital funding remains selective.

The semiconductor industry faces particularly acute challenges. Industry experts estimate that the tariffs increase production costs by 12-18% for companies using global supply chains—even as domestic initiatives aim to strengthen local production.

Semiconductor stocks have shown volatility following tariff announcements, reflecting investor concerns about potential disruption to global supply chains and increased costs for US companies relying on foreign chip manufacturing.

Impact on Consumer Tech Budgets

What does this mean for consumers and their tech purchases? Several patterns are emerging:

- Premium smartphone prices are projected to increase by $75-200 for flagship models this year, according to industry analysts. Mid-range models, often operating on thinner margins, may see proportionally higher increases.

- PC and laptop manufacturers are adopting varied approaches. Some have announced expected price increases of 8-12% on consumer models, while others pursue “blended strategies” of partial price increases combined with component substitutions.

- Smart home devices, which often operate on razor-thin hardware profits with business models centered on subscriptions or data, are seeing some of the most visible price adjustments, with popular voice assistant devices already increasing in price by approximately 15%.

The timing of these increases varies by product category and inventory cycles. Retailers with existing stock imported before the tariffs took effect can temporarily buffer consumers, but industry analysts expect full price impacts to be visible by summer.

Adaptation: The Tech Industry’s Response

If there’s one thing the tech industry excels at, it’s adaptation.

Manufacturing shifts that began during the first round of tariffs have accelerated dramatically. Taiwan-based manufacturers that produce for numerous American tech brands have announced expansion of planned manufacturing facilities in the United States, with new sites in Wisconsin and Arizona—signals that reshoring is gaining momentum.

Supply chain analytics indicates that tech companies have initiated significantly more supply chain diversification projects in early 2025 compared to all of 2024, with India, Mexico, and Malaysia seeing the greatest increases in new tech manufacturing initiatives.

Innovation in materials and design may ultimately produce unexpected benefits. Companies are reimagining products with fewer components, more modular designs, and sometimes even better repairability as they optimize for these new economic realities.

Economic analyses suggest that these adaptation strategies come with their own costs—estimated in the billions in adjustments during previous tariff rounds. This highlights why consumers will inevitably bear some portion of these costs, even as companies work to mitigate them.

Reshaping the Tech Landscape

Beyond immediate price increases and supply chain adjustments, the tariffs point toward a potential fundamental reshaping of the tech industry.

The most significant long-term impact may be a more regionalized approach to tech manufacturing and markets. Industry consultancies project that by 2027, North America could produce significantly more consumer electronics than it did in 2023—potentially reversing decades of offshoring trends.

For consumers, this could eventually mean products designed specifically for regional markets rather than global ones. Your next smartphone might be more expensive initially but potentially designed with local preferences and regulations in mind.

American tech workers could see expanded opportunities as companies invest in domestic R&D and manufacturing. Some economic forecasts project growth in domestic tech manufacturing jobs over the next three years—though many will require different skills than previous manufacturing eras.

“We’re not returning to the tech manufacturing environment of the 1980s,” as one economist noted in a recent industry forum. “We’re creating something new—more automated, more specialized, and potentially more resilient.”

Finding Balance in a Changing Tech Economy

As these economic forces play out across boardrooms and assembly lines worldwide, the impacts will eventually reach our homes and pockets.

In the short term, being a tech consumer means becoming a more strategic one. The predictable annual upgrade cycles we’ve grown accustomed to may no longer make financial sense if price increases outpace meaningful innovations. The secondhand and refurbished markets—already growing for sustainability reasons—could see additional boosts as consumers seek alternatives to higher prices.

For businesses, particularly small and medium enterprises, technology purchasing decisions now require more careful consideration of timing, necessity, and long-term value. The days of treating tech as an easily replaceable commodity may be waning.

What’s clear is that the intersection of trade policy and technology has never been more consequential for everyday consumers.

That smartphone you checked this morning tells a story not just of technological innovation, but of an industry and a consumer base adapting to a rapidly changing economic landscape. How we respond—as consumers, as businesses, and as a society—will determine whether these changes ultimately strengthen or weaken both our technological future and our economic resilience.

Editor’s Note: This article synthesises information from multiple industry sources, economic analyses, and market reports published between January and March 2025. Some originally cited sources may no longer be publicly accessible. The analysis relies on data from organisations including the US Census Bureau, industry trade associations, and economic research institutions. The charts and statistics presented reflect available public data as of publication.