Samsung Electronics Co., Ltd. has announced some impressive numbers on a consolidated basis, for the fourth quarter ending December 31, 2011. The electronics giant recorded consolidated revenues of 47.3 trillion won ($42.12 billion) which is a 13 percent increase year-on-year. The company posted an operating profit of 5.3 trillion won ($4.7 billion) for Q4 2011, a strong 79 percent increase year-on-year.

[ad#Google Adsense 336×280]

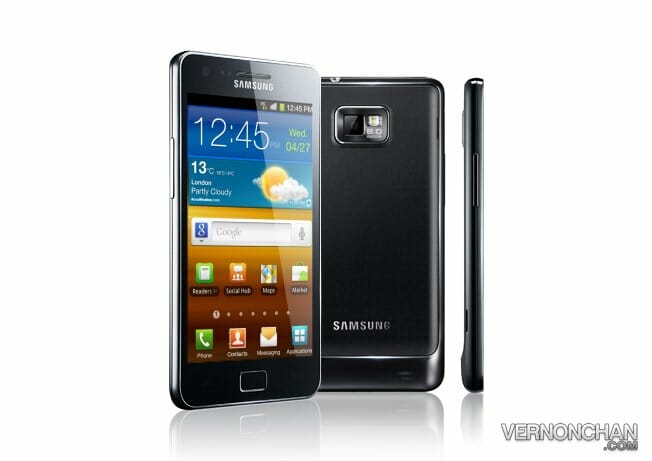

The impressive fourth quarter results brought Samsung’s full year 2011 revenue to an all-time high of 165 trillion won ($146 billion), up 7 percent from the previous year. Its telecommunications business reached quarterly earnings of 17.82 trillion won ($15.77 billion), up 52 percent from the previous year, spurred by strong sales of Samsung’s GALAXY S II and GALAXY Note. Total sales for fiscal year 2011 also hit an all-time yearly high of 55.53 trillion won ($49.15 billion), accounting for almost one-third of Samsung’s total revenue for the year. The line up of its high-end mobile devices and entry-level models drove up revenue for the year by almost 40 percent compared with the previous year. Shipments of Samsung smartphones rose by approximately 30 percent in the fourth quarter, compared with the previous quarter.

Demand of entry-level smartphones and tablet PCs is expected to increase significantly this year, while growth of feature phones is expected to stay static. The spread of LTE and growth of emerging markets is expected to boost the growth of the smartphone market by more than 30 percent.

For the global market outlook for this year, demand for entry-level smartphones and tablet PCs will increase significantly, while the growth momentum for feature phones is expected to stay static. Emerging markets and the spread of LTE (Long-Term Evolution) wireless telecommunications technology have also contributed to the growth of the smartphone market, which is expected to grow by more than 30 percent.

Samsung’s reinforced lineup of LED TVs has also improved quarter-on-quarter sales.

Samsung’s Semiconductor Business saw demand for PC DRAM remain weak but growth of specialty products such as server and mobile DRAM was constant due to the rising demand for smartphones and tablet PCs. Although profitability for memory chips and LCD declined, rapid growth in system LSI and OLED panels was a promising signal for future growth.

Read the full press release below.

[spoiler title=”Show Official Press Release”]

Samsung Electronics Announces Fourth Quarter & FY 2011 Results

Achieves full year net income of 13.73 trillion won on sales of 165 trillion won

4Q consolidated revenues reach 47.3 trillion won, operating profit of 5.3 trillion won

SEOUL, Korea – January 27, 2012 – Samsung Electronics Co., Ltd. today announced revenues of 47.3 trillion Korean won on a consolidated basis for the fourth quarter ended December 31, 2011, a 13-percent increase year-on-year. For the quarter, the company posted consolidated operating profit of 5.3 trillion won, representing a 79-percent increase year-on-year. Consolidated net profit for the quarter was 4 trillion won.

In its earnings guidance disclosed on January 6, Samsung estimated fourth-quarter consolidated revenues would reach approximately 47 trillion won with consolidated operating profit of approximately 5.2 trillion won.

The fourth quarter results brought Samsung’s full year 2011 revenue to an all-time high of 165 trillion won, up 7 percent from the previous year. Net income registered 13.73 trillion won, down 15 percent compared with 2010, while operating profit was 16.25 trillion won, a 6-percent on-year decline.

Highlighting the quarterly performance, the Telecommunications businesses reached record quarterly earnings of 17.82 trillion won, up 52 percent from the previous year, with growth mainly driven by strong sales of Samsung’s GALAXY S II and GALAXY Note. Operating profit for the businesses also hit a record 2.64 trillion won on-quarter.

“Despite intensified competition amid the global economic slowdown, our Telecommunications businesses continued to post solid earnings with an enhanced line-up of high-end smartphones, resulting in higher average selling price (ASP). Moreover, improved profitability and earnings growth of our Set businesses, including smartphones and flat panel TVs led to our company’s strong earnings,” said Robert Yi, Senior Vice President and Head of Investor Relations.

Yi also attributed the solid performance to Samsung’s differentiated technology, cost competitiveness, targeted marketing activities and supply chain management (SCM) capabilities throughout all business units.

Samsung’s reinforced lineup of LED TVs, including premium models for advanced markets and region-specific models for emerging markets, has also improved quarter-on-quarter sales.

On the components business side, the Semiconductor Business saw demand for PC DRAM remain weak but growth of specialty products such as server and mobile DRAM was constant due to the rising demand for smartphones and tablet PCs. Although profitability for memory chips and LCD declined, rapid growth in system LSI and OLED panels was a promising signal for future growth.

Capex to Reach 25 Trillion Won in 2012

In 2012, capital expenditure is forecast to amount to 25 trillion won, in which 15 trillion won will be invested in the Semiconductor Business that consists of memory and system LSI. Of the total Capex planned for this year, 6.6 trillion won will be allocated for investment in the Display Panel (DP) segment, which encompasses LCD Business and subsidiary Samsung Mobile Display.

Last year, Samsung executed a total of 23 trillion won in investments, including 13 trillion won for Semiconductor Business and 6.4 trillion won for the DP segment. Capex for the fourth quarter was around 5.9 trillion won.

NAND Demand Strong Amid Mobile Market Growth

Samsung’s Semiconductor Business – including Memory and System LSI – posted consolidated operating profits of 2.31 trillion won in the fourth quarter. Revenue reached 9.17 trillion won, a 1-percent decrease year-on-year. For the full year 2011, the chip unit registered 7.34 trillion won in operating profits on revenue of 36.99 trillion won.

The Semiconductor Business sustained profitability in the quarter, amid weak market demand, thanks to a mix of high-margin products such as servers and Solid State Drives (SSDs) and robust demand for NAND chips used in mobile devices such smartphones and tablet PCs.

Looking ahead, demand for PC DRAM is expected to remain sluggish in the first quarter due to static global market trends compounded by a recent disruption in the supply of hard disk drives. Demand for NAND flash chips is expected to remain solid with the release of new mobile devices to market, while system LSI will see profits slip in the first quarter, due to off-season market conditions.

For the year, Samsung plans to secure price competitiveness in the market through differentiated mobile and server DRAM products by expanding 30nm-class and below processes. In the case of NAND, the company will focus on securing profitability by consistently expanding 20nm-class processes. Investment in system LSI will be expanded to proactively respond to the rising demand for application processors and image sensors.

Shipments of Value-Adding Panels Rise

The Display Panel Business recorded an operating loss of 0.22 trillion won on revenue of 8.55 trillion won in the fourth quarter and a sales increase of 19 percent from a year ago on the back of peak seasonal demand.

For fiscal year 2011, the Display Panel Business posted a 0.75 trillion won operating loss while posting 29.24 trillion won in revenue.

Despite concerns over a slowdown in sales and a sluggish European economy, demand remained steady during the traditionally high end-of-year season, including ‘Black Friday’ sales in North America, helping the TV panel market to post a 5-percent on-quarter increase. However, IT panel demand was negatively impacted due to the flooding in Thailand, declining on-quarter.

On the back of value-adding products such as LED and 3D TVS, Samsung outpaced market growth by achieving a more than 20 percent increase in TV panel shipments compared to the previous quarter.

Looking ahead, weak seasonality is expected to dampen demand in the first quarter, while demand in 2012 is likely to remain stagnant on concerns over the global economy and oversupply. Samsung will look to secure growth in 2012 with a differentiated product mix, including tablet, 3D and LED television panels, while strong demand for smartphone display panels is forecast to continue.

Smartphone Sales Remain Main Driver

The Telecommunications businesses – including mobile communications and telecommunication systems – posted a record quarterly operating profit of 2.64 trillion won for the period. Fourth quarter revenue reached a record 17.82 trillion won compared with 11.75 trillion won for the same period of 2010.

The stellar performance has allowed Samsung to register full year 2011 operating profit of 8.27 trillion won, up 90 percent on-year. Total sales for fiscal year 2011 also hit an all-time yearly high of 55.53 trillion won, accounting for almost one-third of Samsung Electronics’ total revenue for the year.

Samsung’s flagship GALAXY S II smartphone and its full lineup of high-end mobile devices, such as the GALAXY Note and the GALAXY Nexus, and entry-level models drove up revenue for the year by almost 40 percent compared with the previous year.

All told, shipments of Samsung smartphones rose by approximately 30 percent in the fourth quarter, compared with the previous quarter.

For the global market outlook for this year, demand for entry-level smartphones and tablet PCs will increase significantly, while the growth momentum for feature phones is expected to stay static. Emerging markets and the spread of LTE (Long-Term Evolution) wireless telecommunications technology have also contributed to the growth of the smartphone market, which is expected to grow by more than 30 percent.

The Telecommunication System Business will further solidify its leadership in the wireless network market with the expansion of the LTE service in Korea and North America.

Demand for LED TV to Continue

Samsung’s Digital Media & Appliances businesses, which encompass Visual Display, Digital Appliances, IT Solutions, and Digital Imaging, posted quarterly revenues of 16.96 trillion won for the October to December period, up 4 percent year-on-year. The businesses registered an operating profit of 0.57 trillion won in the fourth quarter.

For the full year 2011, the Digital Media businesses’ combined revenue totaled 58.92 trillion, with operating profit up 229 percent on-year to 1.41 trillion won.

Sales of LED TVs grew strongly during the fourth quarter on traditionally high seasonal demand, achieving 40 percent growth on-quarter. Against this, Samsung outperformed the market by focusing on sales of premium models, shipping over 55 percent more LED TVs compared to the previous quarter.

In 2012, weak seasonality in the first quarter will see an on-quarter decrease in demand although overall market growth is expected for the year, driven by strong growth momentum in emerging markets. In developed markets, Samsung will leverage its premium LED television offerings to lift sales as LED TV sales rise to account for more than 60 percent of the global flat panel TV market in 2012.

For the Digital Appliances market, although the global economic slowdown caused demand to contract for the quarter, Samsung achieved quarter-on-quarter sales growth in developed markets such as the U.S. and Europe. Looking ahead, low growth is expected in developed markets and increasing demand in emerging markets to slow. Samsung expects its diversified product mix, as well as increased operational efficiency, to enhance profitability.

[/spoiler]