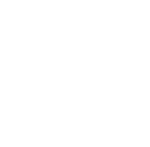

There’s a new e-wallet in town. Grab Malaysia has successfully obtained regulatory approval from Bank Negara Malaysia (BNM) to offer GrabPay e-money services in Malaysia. The introduction of the digital service is in line with Malaysia’s push towards a digital-first economy.

GrabPay is slated to launch in stages in the first half of 2018. The e-money service will allow Malaysians to go cashless and cardless in a simple, safe and secure manner.

The GrabPay e-wallet will be accessible through the same familiar Grab app, which will now cover more than just transport services. In terms of security, GrabPay requires a six-digit GrabPay PIN as a second factor authentication method (2FA). The app will automatically prompt users to input their PIN number when it detects any unusual activities.

Demonstrating the GrabPay e-wallet at the Bank Negara Payment Systems Forum, Jason Thompson, Managing Director of GrabPay shared: “Cash is still the most important payment method for many Malaysian SMEs and middle-class consumers, despite most adults having a deposit account. As one of the region’s most frequently used consumer apps with 72 million downloads, we are happy to work with Bank Negara to drive mass adoption of mobile payments in Malaysia and across Southeast Asia.”

BNM reports that cash handling and services costs MYR1.8 billion a year to the banking industry. Electronic-based payment may help save up to 1% of a country’s economy due to lower retail payment cost, compared to cash payments.

As you may know, Malaysia is rapidly moving towards a high-value, digital-first economy, and has devised progressive policies such as the Malaysian Financial Sector Blueprint (MFSC) 2011-2020. The MFSC aims to increase the number of electronic payments per capita to 200 by 2020.

BNM recently announced that it is waiving the 50 sen transaction fee for online Instant Transfer, for transactions of up to MYR5,000. This will be in place by 1 July 2018. It is also increasing cheque fees from 50 sen to MYR1.00 in efforts to encourage consumers and businesses to move to electronic banking.