Today, Grab announced its “Grab for Good” social impact programme aimed at empowering people in Southeast Asia. Grab has set ambitious goals over a five-year timeline to upskill and provide equal access to opportunities for Southeast Asians in the digital economy. Since its inception in 2012, the company has greatly impacted millions of lives and disrupted markets across the region. For the first time, Grab has released its Social Impact Report based on a 12-month timeline up until March 2019. Here are some key facts.

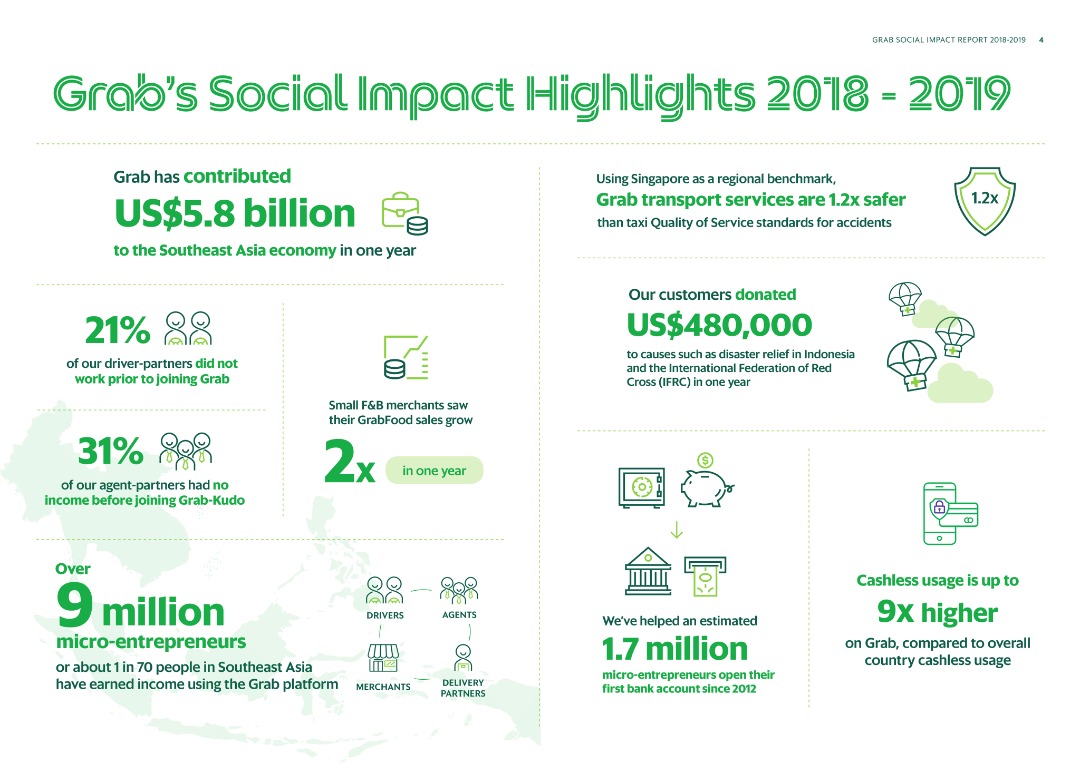

Grab is estimated to have contributed USD5.8 billion to the Southeast Asia’s economy.

The Grab ecosystem has enabled 9 million micro-entrepreneurs, or approximately 1 in 70 people in Southeast Asia to earn an income. They comprise driver-partners, deliver-partners, merchants, and agent-partners.

Some 21 percent of Grab driver-partners did not work prior to joining Grab and 31 percent of agents had no prior income before joining Grab-Kudo. Kudo is a platform that provides opportunities to Indonesians to grow their business through technology. There are currently more than 2.6 million registered Kudo agents across 500 cities and towns throughout Indonesia. Grab acquired Kudo in May 2017.

According to KPMG, only 27 percent of Southeast Asia’s 658 million people own a bank account (Data: April 2019), and only 33 percent of SMEs have access to loans or lines of credit (Business Times, April 2019). Grab has helped over 1.7 million micro-entrepreneurs open their first bank accounts.

Also, 1 in 4 driver-partners received financing products from Grab who would have otherwise been turned down by traditional banks.

The company is also helping push the region into a cashless future. Cashless usage is up to 9x higher on Grab, thanks in part to GrabPay. Between April 2018 to March 2019, cashless transactions on the platform quadrupled. In Malaysia, while only 5 percent of transactions in the country are cashless, 20 percent of overall cashless usage is via Grab. In more developed countries like Singapore, the numbers are 57 percent and 77 percent respectively.

With insurance penetration in Southeast Asia lingering at only 3.6 percent, well below the global average of 6.1 percent, Grab has rolled out several insurance schemes to better protect driver-partners and customers. All driver-partners and passengers are covered by Grab’s Group Personal Accident Insurance. Fifteen out of 100 Grab driver-partners benefit from one or more insurance coverage plans offered by Grab: healthcare, life, motor, and prolonged medical leave insurance.

For countries like Malaysia, where under new e-hailing regulations, driver-partners are required to get an e-hailing insurance, Grab introduced a first-of-its-kind insurance product—daily insurance. The MYR1 (USD0.24) our day, pay-only-when-you-drive scheme is part of its “Pakej Pikul Bernama” programme, a partnership with the Central Bank and 14 insurance companies.

Using Singapore as a regional benchmark, Grab transport services were found to be 1.2x safer than taxi Quality of Services standards for accidents, and 1.9x safer in terms of driver-related offences.

Lastly, through GrabRewards, Grab customers have an easy, convenient way to help other Southeast Asian neighbours in need. Customers can use their GrabReward points to donate to charities of their choice. In total in a span of one year, 700,00 customers have donated 280 million GrabReward points, totalling USD480,000 in value, to causes such as disaster relief in Indonesia and the International Federation of Red Cross (IFRC).

While it is proud at its achievements thus far, Grab admits its work in Southeast Asia is far from done. In the coming year, it plans to grow its impact to building more products that solve everyday problems; continue to find ways to leverage its network strength to deliver impact at scale; and continue to seek collaboration with like-minded partners be it governments, international organisations, NGOs or private companies.